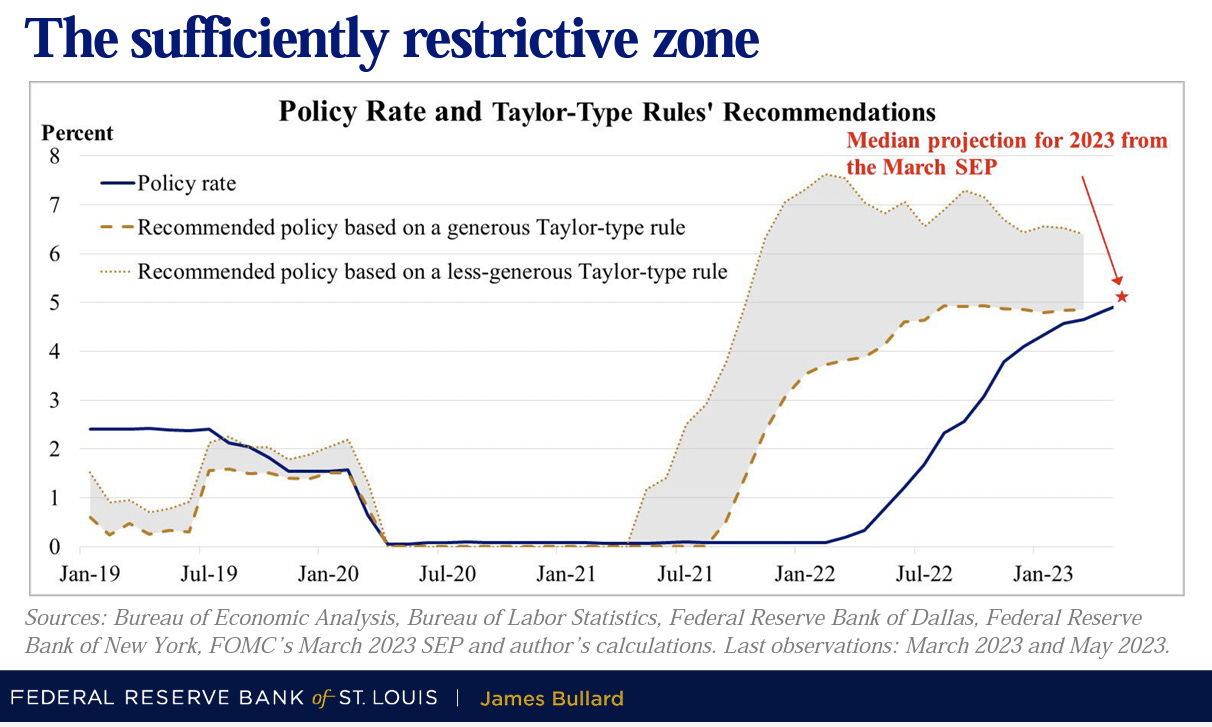

Will the Fed Remain Tight for Too Long and Trigger a Recession?

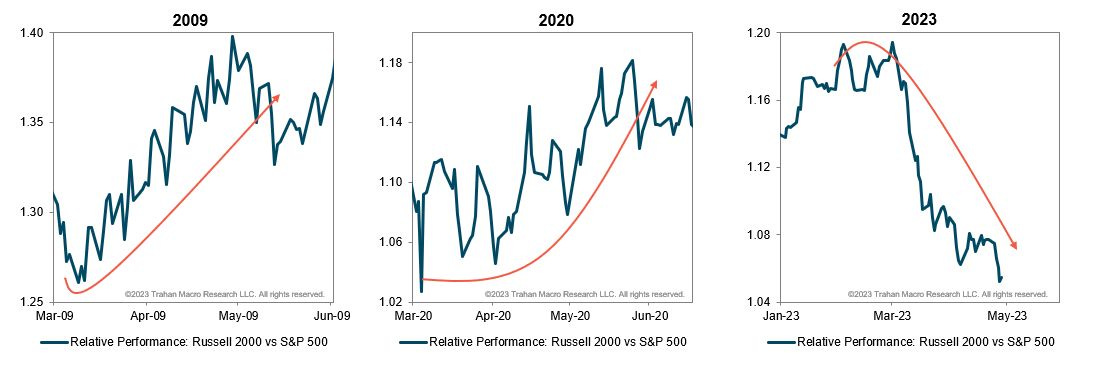

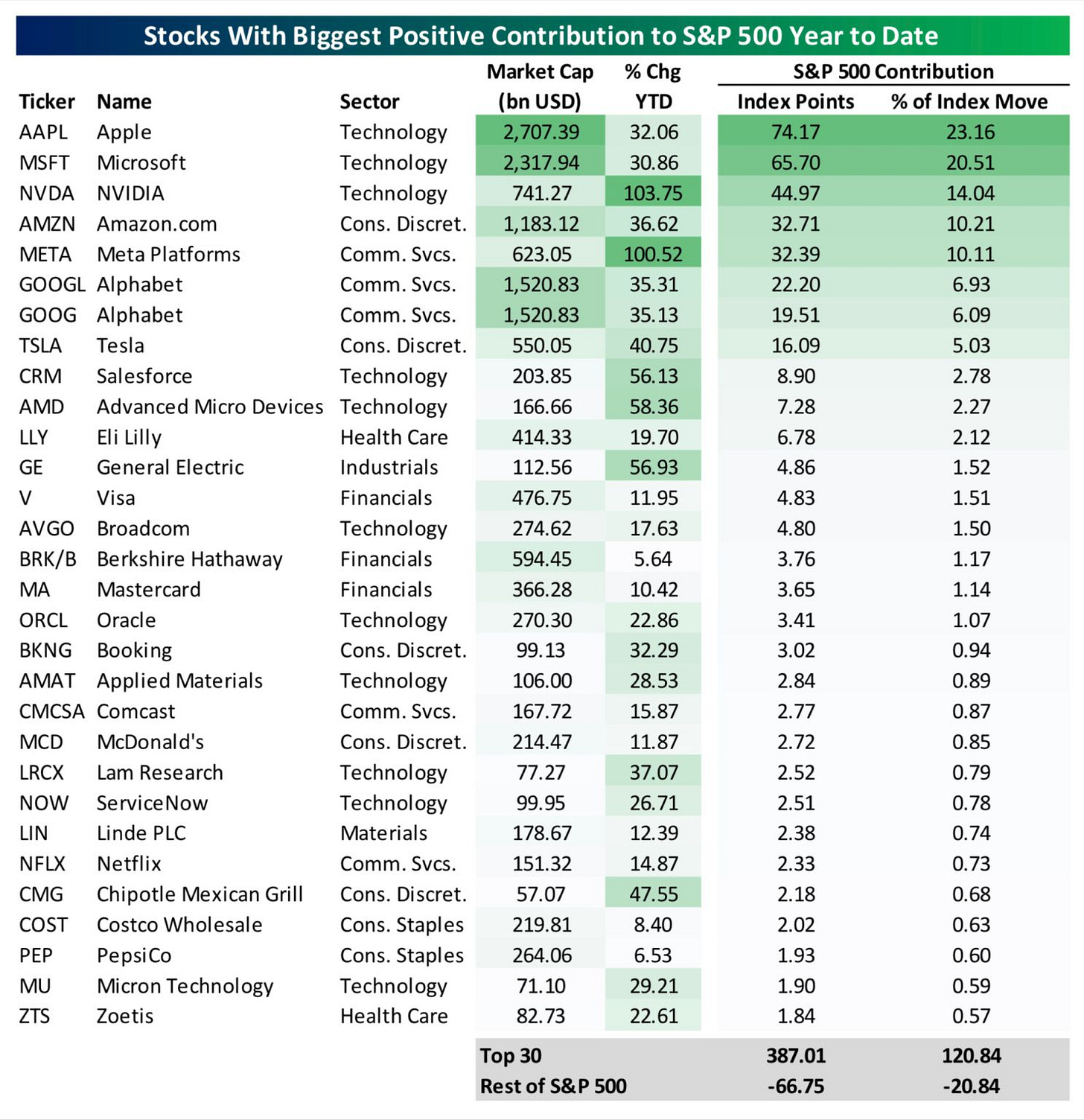

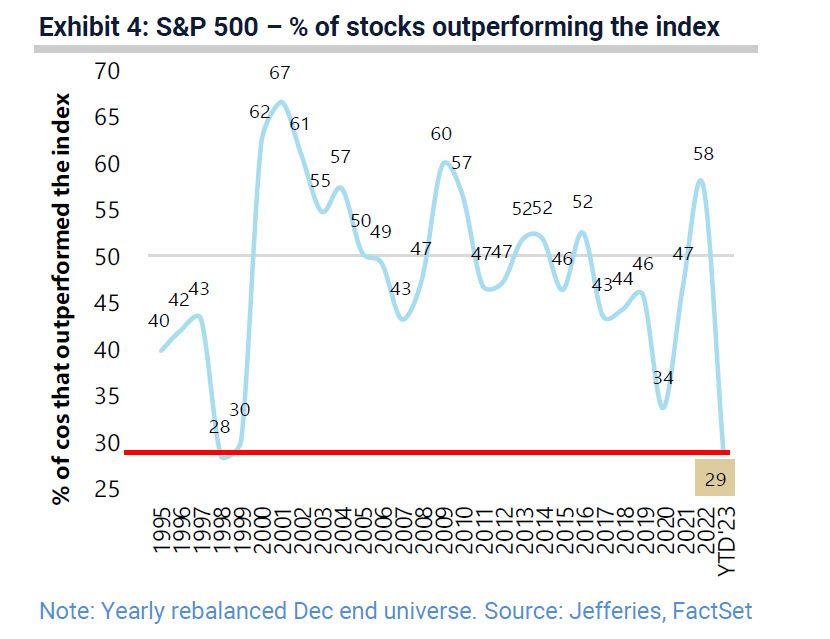

Interest rate chicken, historical bear markets, market leadership, AI bubble, Japan inflation, sell in May?

Welcome! I’m Sarah Connor and this is my investing newsletter. If you’re new, please subscribe below:

Now on with the program…