A generation in Canada is destroyed

Unless housing prices crash significantly, Gen Z will never succeed in Canada.

Unless housing prices crash significantly, Gen Z will never succeed in Canada.

The middle class dream of an entire Canadian generation is destroyed before most of them have even thought that far into their future.

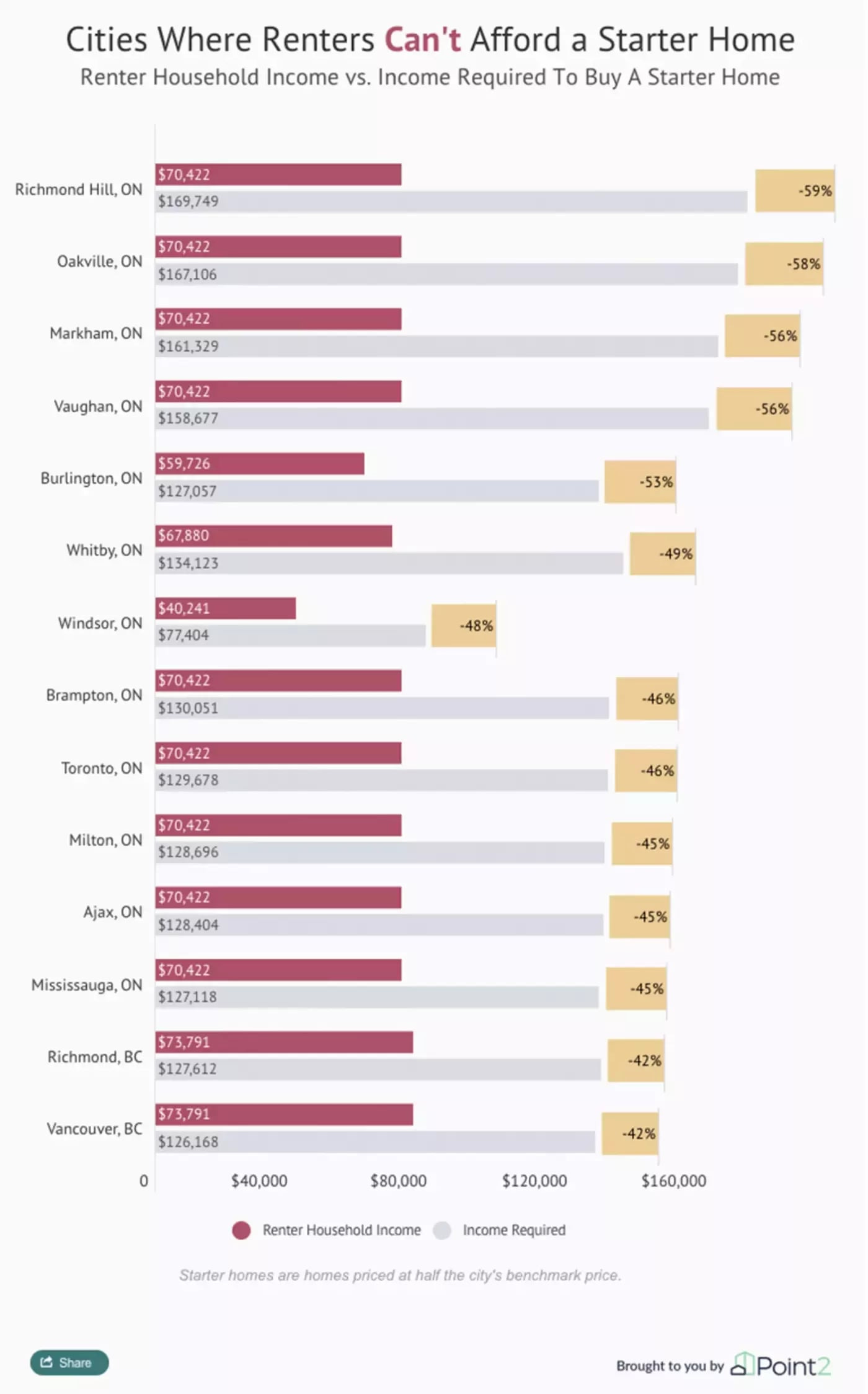

Sure, some determined Gen Zers will still manage to buy a house, but not without wrecking their quality of life for at least a couple decades. Due to extreme house-price-to-income ratios across Canada - especially Toronto and Vancouver - most Gen Z will live with their parents or roommates for much longer than any previous generation.

Given that a six-figure salary is no longer sufficient to buy a home, household formation will be a luxury bequeathed by wealthy families to their heirs. And so the new Canadian system of Feudalism begins.

Those with options - skills and financial support - will move to areas with more affordability, leading to a brain drain out of the big cities and the country.

You’d think that unaffordability would curtail demand and put a lid on housing prices in Canada, but not even the rapid ascent of mortgage rates can erode the lust for real estate. The system is broken and to save Canada the screws need to be tightened until there is real pain.

Despite a respite from the madness in the Canadian housing market in 2022, so far higher rates have been ineffective at cracking the market. BMO’s Canadian rates and macro strategist Benjamin Reitzes:

As my colleagues Doug Porter and Robert Kavcic have rightfully stated a number of times: If the most interest rate sensitive part of the economy isn’t buckling under the pressure of higher rates, then policy rates likely aren’t high enough…

Higher mortgage rates have been ineffective for three reasons.

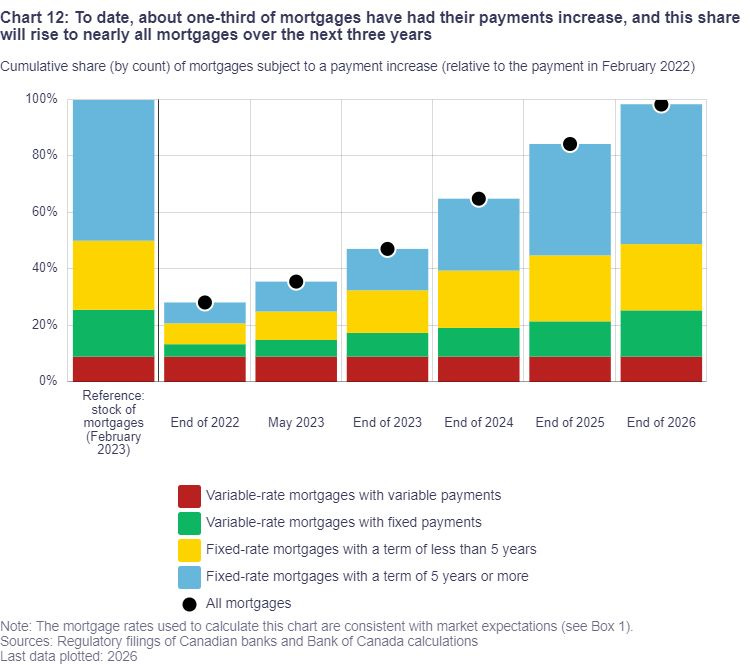

Reason 1: It takes time

According to the Bank of Canada, it will take about 3 years for higher rates to impact almost all mortgages as fixed terms renew. So far, about 1/3 of mortgages have been affected. Based on the Bank's expectations, the median payment increase over the 2023–26 period will be about 20%.

Reason 2: Monetary policy is swimming against population growth

Demand for housing is growing rapidly as roughly 83,000 people move to the country each month. Canada’s population grew by 4% in 2022. This growing demand more than offsets any downward pricing pressure caused by higher mortgage rates. This lack of Federal coordination has got to be frustrating for the Bank of Canada.

Tiff Macklem (Bank of Canada Governor) pointed this out during a recent press conference:

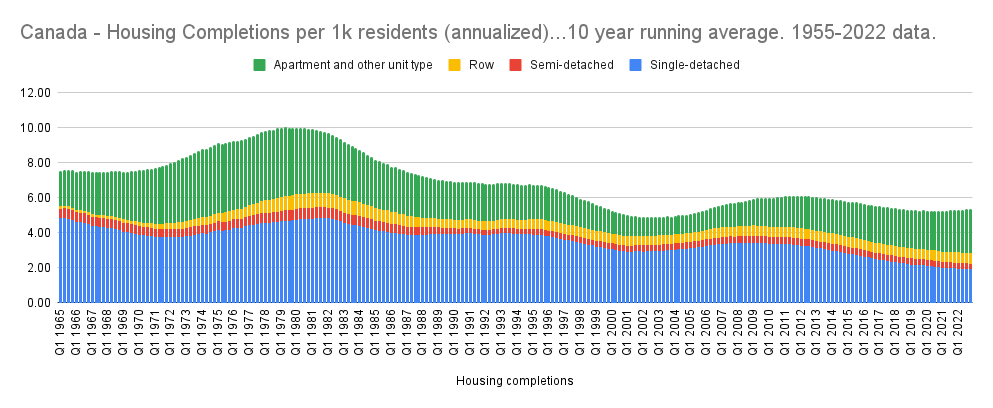

Reason 3: Canada simply is not building enough houses

The rate of homebuilding (completions per 1,000 residents) peaked in the early 1980s and has declined ever since.

With only one out of three policy levers pushing against the housing bubble, nothing will get fixed.

Unless something changes dramatically soon, Gen Z and future generations are screwed.

It angers me that your work isn't being read more. I'm a huge fan.