1. Canada’s 21st Century Brain Drain

You’d think a software engineer earning $200,000 could live a good life in Canada. Wrong!

The best and brightest - the future of Canada - can’t afford to live in Canada and they’re fed up. If people with top decile salaries can’t make it in Canada who can?

Here’s who:

People who bought property 5+ years ago

Couples with dual top-decile salaries and no kids

People who received generous gifts from their parents

People who live in multigenerational households (i.e. kids never move out)

Until recently, someone from a lower-income background could earn a degree, get a decent job and comfortably ease into the middle-class lifestyle.

Not any more.

Hard work and diligent saving doesn’t cut it any more.

Yet, there are places in the world a bright, hardworking person can afford a fantastic life. Canada’s top young talent is leaving the country to live in real world class cities with great culture, complete infrastructure (that’s a jab at the Eglinton LRT) and affordable shelter.

Welcome to Canada’s 21st century brain drain.

Either housing prices decline or Canada loses its competitive standing in the world marketplace.

Here’s the experience of a software engineer who moved to Canada three years ago, regretted it and is now leaving. This story is not unique:

We came to Canada exactly 3 years ago as a permanent residents, after qualifying for a very tough express entry program. I got everything right, an 8.0 overall IELTS score, an Software Engineering masters & bachelor's degree from U.K and a good software engineering job experience under my belt. I'm so good at what I do that I cracked 4 interviews out of 5 interviews and secured a high 6 figure salary which is now very close to 200k.

Everything has been good, except the housing situation…

He discusses his experience bouncing from rental to rental, while rent prices doubled. He continues, describing his experience searching for a house to buy.

I've also looked into what I can buy and my pre approval came in at 790k and I know that I won't be able to able to find anything for that price except for a 2 bed condo and I hate condos and we are a family of 4, so that's not an option. Sadly I can't move to another place or province because of my job. Also the main reason I think I'm unwilling to buy here is that I don't want to pay 800k for houses which costed 400k just 3 years ago, we are not fools you think we are and we certainly don't want to be debt slaves for the rest of our lives cooped up in a shoebox.

After exhausting all options, yesterday my spouse and I decided, it's best to leave Canada and return back to our home country. We decided to do this despite now being eligible to apply for citizenship; because we don't feel Canada is a place for people who want to learn and grow, but is more like a retirement community for people who have retired and checked out mentally and don't want to work hard and contribute to economy and this is the reason we think this country is going to fail.

I'm very sorry for the young people here, especially millennials and gen Z, but sadly I can't waste any more of my youth and hard earned money to pay people extracting rents and also paying about 50% tax and for private healthcare in future.

So consider this a bye bye from an immigrant who could have called this country their new home, but cannot due to rampant corruption and greed at all levels of government.

Let this also be a message to people who want prices of houses to rise forever and who are banking on immigrants to come here and pay them rents. We are not fools and many of us have the ability to find jobs elsewhere where we are respected.

Bye bye, Canada!

New homebuyers aren’t the only people struggling. Recent purchasers are facing a refinancing nightmare as variable rates reset or the classic 5yr fixed term renews.

According to Desjardins Managing Director Royce Mendez, “a first time homebuyer who purchased a house in 2018 for $1,000,000 and put $200,000 down would need to put up another $160,000 to keep their monthly mortgage payment steady.”

“Our simulations show how vulnerable some homeowners will be when it comes time for renewal. There are likely some homeowners who have no idea what type of payment shock they could be in for.”

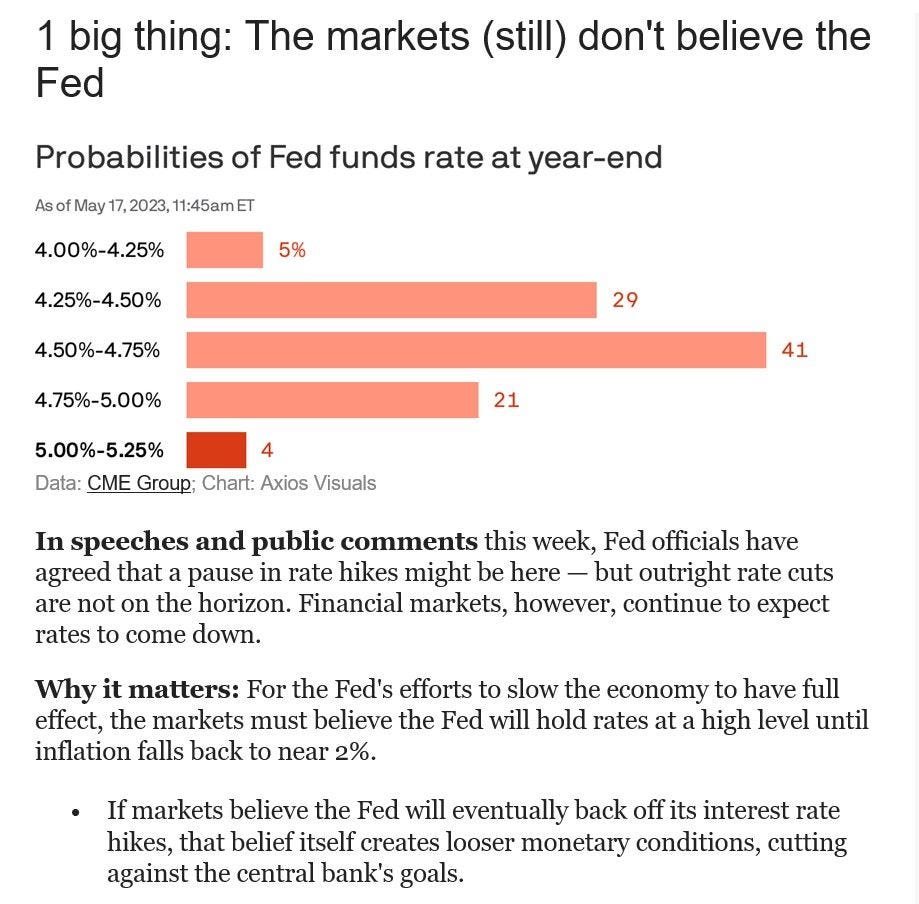

2. Is the Fed All Talk?

Fed Says: We’re holding rates steady with no plans to cut.

Market Says: Sure buddy. You’re going to cut by year-end.

3. End of the Secular Bull Market?

2009-2020 was an especially strong period for market returns. This bull market ended with high valuations, implying much tamer forward returns.

According to Jurrien Timmer, Director of Global Macro at Fidelity Investments returns expectations need to come down as the last bull market comes to an end.

Here’s what he says to expect:

History tells us that when a secular bull market matures (not yet over, but approaching twilight), the leadership will change from growth to value, large to small, stocks to commodities, and from US to international equities. When this happens, we tend to see a secular rhythm in terms of the duration and magnitude of those pair-trades. Once they get going, the trend tends to persist.

Higher inflation tends to lead to lower valuations, which suggests that the P/E-driven phase of the secular bull market is behind us, and that rising nominal earnings will drive the next (and final) phase.

4. AI News

Are We Ready for AI to Raise the Dead?

The article discusses the concept of digital immortality through AI, suggesting that AI advancements could enable the creation of digital facsimiles of deceased individuals using their voice recordings, videos, and text data. However, this raises ethical questions around posthumous representation and potential misrepresentation.

These ethical considerations will soon need practical resolution, with issues of algorithmic bias, privacy, misinformation, job displacement, and deepfakes all needing to be confronted. There's currently no broad agreement on who should make these decisions.

The author calls for proactive regulation, involving federal government and industry-wide social standards to shape technology development. The article also highlights the need for established ethical guidelines in AI research, comparing the situation to the ethical structures in biomedical research.

I’ve previously written about the idea that AI could lead to a rudimentary version of immortality:

Immortality 1.0

At the current pace of AI, nano-robotics and human genomics development, it is possible that the natural life of human beings could eventually be significantly extended sometime in the future. True immortality, if possible, remains years into the future. According to

OpenAI CEO Testifies on Artificial Intelligence

OpenAI CEO Sam Altman: "If this technology goes wrong, it can go quite wrong."

Altman seems 90% optimistic / 10% pessimistic, as he predicts job creation resulting from AI. However, as I’ve pointed out before job creation could come with decades of transformational pain for the labor market. This is what happened during previous industrial revolutions.