At the end of the day we all know there's a 99% probability the debt ceiling is raised. So why endure this performance every couple years?

The debt ceiling once had it's purpose (to hold the President accountable), but today Congress has other means to negotiate budgets.

So why does the debt ceiling still exist? James Surowiecki (author of The Wisdom of Crowds) explains in a 2011 New Yorker article:

"One argument you hear for having a debt ceiling is that it’s useful as what the political theorist Jon Elster calls a “precommitment device”—a way of keeping ourselves from acting recklessly in the future, like Ulysses protecting himself from the Sirens by having himself bound to the mast. As precommitment devices go, however, the debt limit is both too weak and too strong. It’s too weak because Congress can simply vote to lift it, as it has done more than seventy times in the past fifty years. But it’s too strong because its negative consequences (default, higher interest rates, financial turmoil) are disastrously out of proportion to the behavior it’s trying to regulate. For the U.S. to default now, when investors are happily lending it money at exceedingly reasonable rates, would be akin to shooting yourself in the head for failing to follow your diet."

Surowiecki wrote that during the 2011 debt ceiling debacle after - for the first time ever - the US was downgraded below a AAA rating by S&P. During that period, the S&P 500 fell by roughly 20%.

Yesterday, Fitch placed the US on watch. A gesture to show they're paying attention to the showmanship, but ultimately see no real threat.

"The Rating Watch Negative reflects increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching x date (when the U.S. Treasury exhausts its cash position and capacity for extraordinary measures without incurring new debt). Fitch still expects a resolution to the debt limit before the x-date. However, we believe risks have risen that the debt limit will not be raised or suspended before the x-date and consequently that the government could begin to miss payments on some of its obligations. The brinkmanship over the debt ceiling, failure of the U.S. authorities to meaningfully tackle medium-term fiscal challenges that will lead to rising budget deficits and a growing debt burden signal downside risks to U.S. creditworthiness."

How are markets reacting to the approaching debt ceiling?

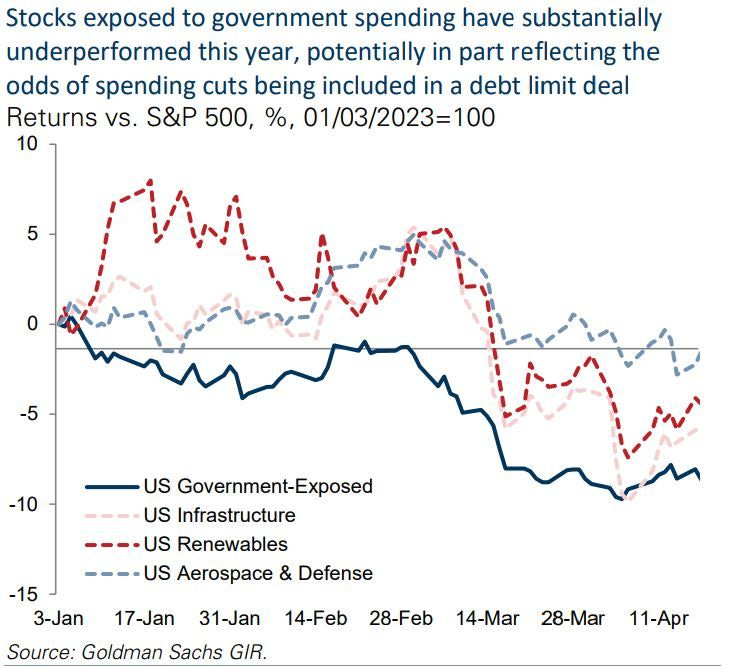

Overall, the broad stock market is up YTD. Markets reaction to the approaching debt ceiling is limited to sectors especially exposed to government finances (chart below).

What do the pros think about ongoing debt ceiling talks?

"Over the longer term, political polarization that manifests as repeated brinkmanship over raising the debt limit casts a cloud over not the institutional capacity of the US government to repay its debt, but the political willingness to do so, which can't be good for any US asset."

- Stephen B. Kaplan, Associate Professor of Political Science and International Affairs, George Washington University

"The underlying issue, as it was back when S&P downgraded the US’ credit rating, is the trajectory of public debt... Worsening political polarization was also an important factor in the [2011] downgrade... And it’s hard to argue that political polarization has done anything other than continue to worsen since 2011."

- David Beers, Former Head of Sovereign Credit Ratings, Standard & Poor’s, Senior Fellow, Center for Financial Stability

"Lawmakers will most likely agree on a deal in time... [but] I’d place the odds of not getting a deal in time at about 10%—higher than at any point since the 2011 debt limit crisis—because the politics for getting a deal done are worse today."

- Alec Phillips, Chief Political Economist, Goldman Sachs

Source: Top of Mind, Global Macro Research, Goldman Sachs