How accurate is the Federal Reserve at predicting recessions?

Plus: Interview with Stanley Druckenmiller

Welcome! I’m Sarah Connor and this is my investing newsletter. If you’re new here, please don’t forget to subscribe:

Now on with the show…

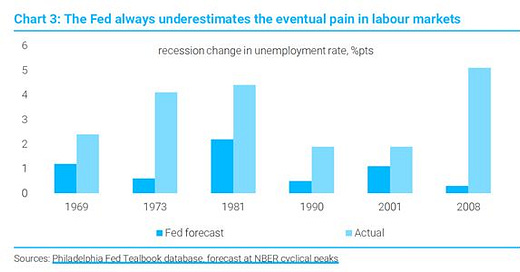

Fed is terrible at predicting recessions

It’s understandable that the Fed - and other government officials - would have a positive bias. What would the reaction be if Bernanke back in 2008 issued a press release saying he expected a financial crisis and massive unemployment? And if his predictions came true, many would suggest it was his comments that panicked the markets and caused the crisis in the first place.

The 400 PHD economists at the Fed can’t all be wrong. They simply know their place and must overweight their communications and policy to real world data. Arguably, it’s not their job to extrapolate too far from the straight-line forecasts.

Bottom line: listen carefully to the observations and communications by central bankers, but don’t depend on Fed forecasts.

Is AI acceptance cultural?

A recent survey by Ipsos asked people around the world “Do products and services using AI have more benefits than drawbacks?”

People in wealthier countries are more likely to feel threatened by AI.

Respondents in developing nations were more likely to embrace the benefits of AI.

Without reading too much into this, I wonder if one group feels more threatened because it has more to lose. Or because it has already felt the negative effects of automation, while the other has benefited from offshoring. Or perhaps the nature of work between developed and developing nations impacts the perceived threat.

Ultimately, I wonder if differing degrees of acceptance will affect national competitiveness in the future.

Even within countries there are varying degrees of knowledge, interest and acceptance. Pew Research recently found that 58% of Americans have heard of ChatGPT but only 14% have tried it.

Of those who have tried ChatGPT, 35% have found it very-to-extremely useful. Younger people are more likely to find it useful.

Keep in mind that perception of usefulness has nothing to do with actual utility. Especially for a tool in its infancy. Many would have had the same response to the internet back in 1993.

Is NVIDIA too expensive (continued)?

The chart below (source: Crescat Capital) plots NVIDIA’s real free cashflow yield (free cashflow yield minus fed funds rate) since 2014. Arguably, the higher the real cashflow yield the greater the value.

Based on this calculation, NVIDIA’s real free cashflow yield is negative and at it lowest point in a decade.

Legends interviewing legends: Kiril Sokoloff in conversation with Stanley Druckenmiller

Turn on closed captioning - some of the audio is difficult to hear. This is a deeply insightful conversation once you get over the audio issues.