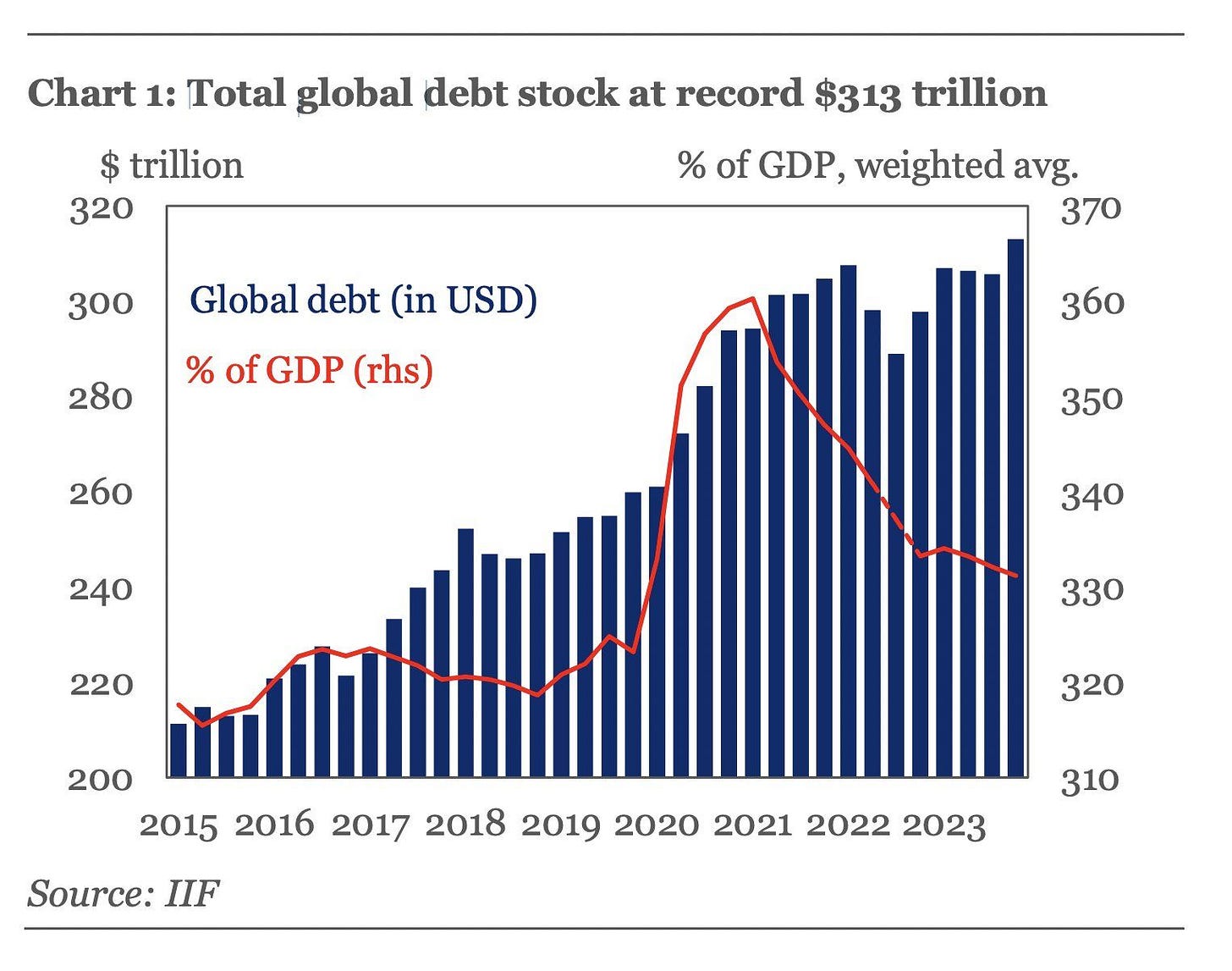

Debt is out of control?

Maybe not. As a percentage of global GDP, debt levels have declined over the last few years.

Buffett on bubbles: Excerpt from letter to Berkshire shareholders in 2000

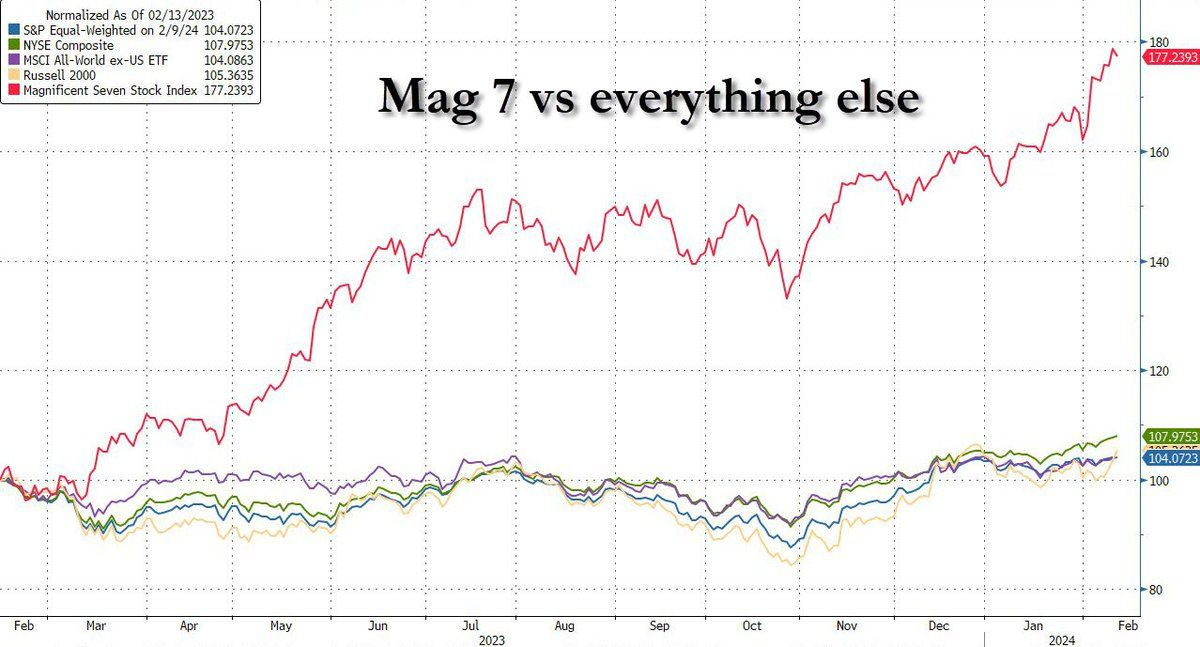

So is Mag 7 or AI in a bubble then?

Here’s the difference between today and 2000: In 2000, almost all internet stocks were unprofitable cash-burning machines. Today, the Mag 7 are experiencing huge top and bottom-line growth.

If you were underweight the Mag 7 in 2023, you massively underperformed the broad cap-weighted market. I don’t know how long the Mag 7 outperformance can last, so for now I’m not going to guess.

Today, the S&P 500 is heavily concentrated in a handful of of these Mag 7 names. Some consider an equal-weighted market index as a way to mitigate the risk that market leaders fall from their lofty heights. But does market concentration really matter?

On one hand, the concentration exists for a reason - these companies are generating massive cash flows and have huge growth trajectories. On the other hand, concentration = risk if they all go down together.

Josh Brown is apparently a fan of using a cap-weighted index.

Other research is more evenly divided between cap-weighted and equal-weighted indexing.

Looking at the time-series below, two notable periods pushing up the equal-weighted index average return include the early 2000s and 2008/2009 bear market, during which the previous market leaders imploded. Excluding these two periods, I’d guess (I’m just eyeballing it here) that the balance tilts in favor of the cap weighted index.

Personally, for my US equity exposure I use a dirt cheap cap-weighted index.