Is This the Start of a New Secular Bull Market?

Looking back at the dot com bubble

Welcome! I’m Sarah Connor. I’ve dedicated the past 20+ years to unlocking the secrets to building wealth in a world that wants to extract every penny from your wallet.

Subscribe today!

It’s 1995.

In August of that year Netscape made its stock market debut priced at $28 per share. On its first day of trading, the little known internet browser company traded as high as $74 per share.

The internet bubble had begun, marking the second half of a longer boom created by innovations in computing and telecommunications.

Over the next 5 years, more internet companies were created and IPO’d as investor thirst for exposure grew. Many existing companies pivoted to become dot-com players, although much of it was marketing spin. As the frenzy intensified rationality was abandoned.

Traditional metrics for valuing companies like profits and cashflows were replaced with eyeballs and clicks. Build it now and figure out the path to profitability became a business mantra.

During 1995 and 1996, a rational investor observing stocks doubling on their first day of trading would argue it’s a bubble. It was a bubble. But that bubble continued to expand until March 2000, with the Nasdaq Composite quintupling in value.

Is it better to have loved and lost than never to have loved at all?

During a speculative bubble, rationality evaporates.

Investor FOMO is real. When you see your idiot neighbor earning 30%+ returns you want a piece of the action. Investors of all stripes are drawn into bubbles. Of course, they all go in thinking they’ll get out at the top. Few do.

Even for those who retain rationality, it takes extraordinary fortitude to fight the tide. Imagine being short or underexposed to tech in 1999. Professional investors experienced redemptions and DIY investors watched their friends get rich.

Warren Buffett was one of few investors that avoided the bubble. Over the long run he was proven right, but for years he was considered a relic. Too old to grasp the new paradigm of business. Too set in his ways to extrapolate the productivity gains created by the internet.

Like bubbles of the past, the internet bubble was built off a foundation of truth. The technology was revolutionary and did change the world. Just like the railroads. However, investors tend to overestimate the short-term impacts and underestimate the long-term benefits.

Indirectly, Buffett was an internet investor. Instead of buying high-flying pure-play tech stocks, he owned the lasting businesses that would eventually gain from the societal-wide productivity improvements created by the internet.

After the collapse in 2000, many pure-play dot-com companies vanished yet the infrastructure remained and it was the dominant US companies that eventually benefited.

Buffett didn’t love the internet bubble, but did he really lose out on love? I don’t think so. But he sure did take a psychological beating during the height of the mania.

The following chart plots Buffett’s Berkshire Hathaway against the Nasdaq Composite from January 1, 1995 to January 1, 2005:

Are we at the start of another tech bubble?

The market is in a weird place. There’s roughly a 50/50 split out there among analysts on the direction of the market over the next 12 months - bear market rally vs. new bull market.

What do we know right now:

Leading economic indicators are eroding.

Early signs that the labor market is softening.

Inflation is declining, but remains well above target.

Fed policy rates are probably close to peak, but may remain higher for longer if inflation remains stubborn.

Businesses and consumers have proven resilient, however persistently high rates could bite them as debt rolls over. Word is a wall of corporate debt is maturing in 2025 so supply could start hitting the market next year.

Now the good stuff:

OpenAI released GPT-4 only a few months ago and we are at the start of a land rush to incorporate generative AI into content creation, client interaction and search. This will provide productivity benefits similar to the internet and we’re barely in the first inning.

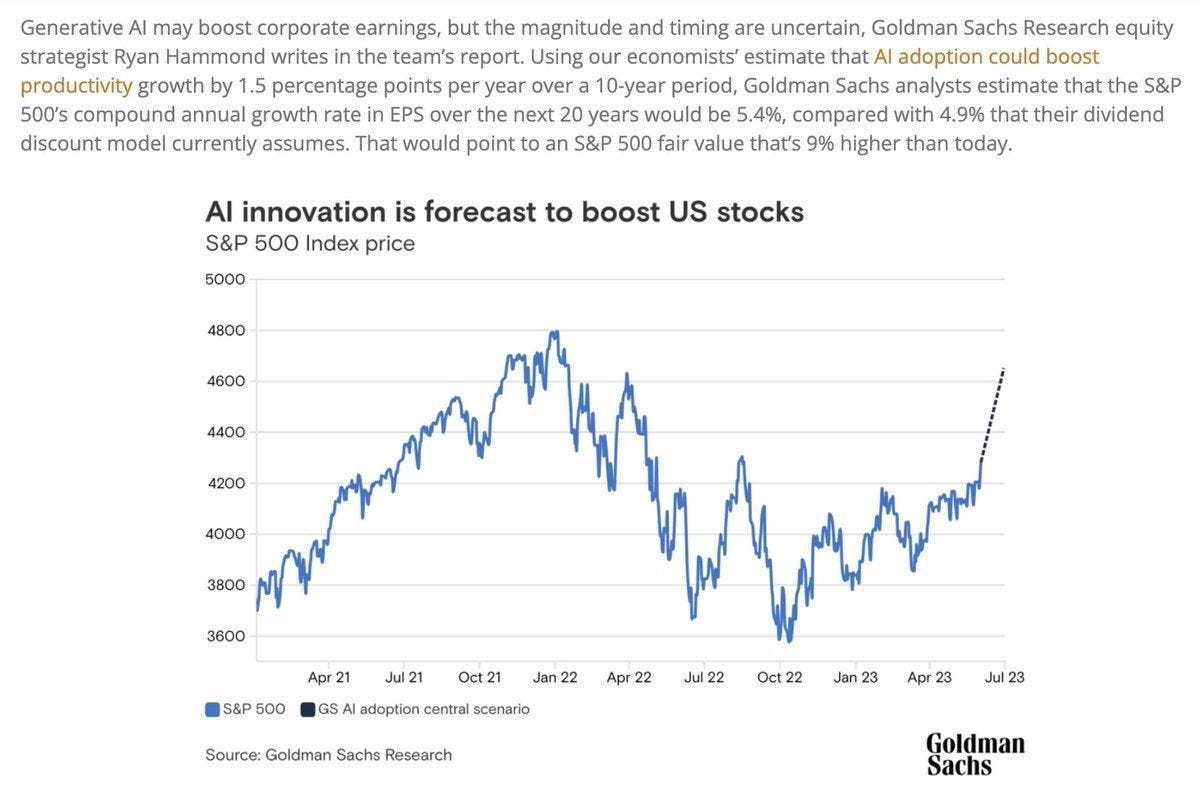

Goldman Sachs estimated (first chart below) the productivity benefit of generative AI at 1.5% added to productivity growth each year for a decade. This means a boost to earnings, and therefore stock prices.

This is a sorely needed boost to the US economy, since productivity has been on a secular downtrend since WWII. The second chart below illustrates the downward linear trend and 10 year moving average for US labor productivity. As you can see, the long-term downward trend is offset by periodic surges, such as the IT boom that began during the 1980s and largely elevated US productivity until the Global Financial Crisis. Adding 1.5% to current levels would take us back to peak post-war productivity!

This isn’t just theoretical. A recent survey by CNBC revealed that 47% of top technology officers across the economy, encompassing both chief information security officers and chief technology officers, say that artificial intelligence is their No. 1 budget item over the next year. Nearly two-thirds say their AI investments are accelerating.

Putting it all together: Start of a secular bull market?

Unless generative AI proves to be a disaster for humanity, over the next couple decades it should unlock serious productivity gains and earnings growth for corporate America.

There will be winners and losers, and many people will lose their jobs. However, putting morality and equality aside, the integration of AI could prove highly profitable for owners of capital - i.e. shareholders - and individuals who can leverage the technology.

While there are solid arguments for a resurgence of the cyclical bear market sometime over the next twelve months, it is quite possible that looking back 20 years from now investors will recognize 2023 as the onset of a new secular bull market. (Remember: long-term trends don’t occur in straight lines.)

I wouldn’t be surprised if this secular bull began with a massive bubble, resembling the tech bubble that occurred from 1995-2000, as investors clamor for pure-play AI exposure. This bubble would eventually collapse, but in its wake productivity enhancements could lift the economic tide benefiting almost all companies.

We had a massive tech rally during the pandemic, now it's calmer so surely this new AI craze will shake up the markets to result in a new bull market?