Jeff Gundlach's Presentation at Jim Grant's Fall Conference

Plus what we're hearing from investment strategists around the world

The latest market insights from global investment strategists and economists:

Jeff Gundlach Presents at 40th Anniversary of Jim Grant’s Interest Rate Observer Fall Investment Conference

Pour yourself a stiff drink, sit in your favorite chair and have a good watch.

Positioning Ahead of a Squeeze on Credit

Torsten Slok, Apollo

1. With the Fed keeping rates higher for longer, higher debt costs will continue to weigh on earnings and interest coverage ratios over the coming quarters, and both IG and HY companies will experience higher refinancing costs.

2. A default cycle has started with bankruptcy filings rising, and default rates will continue to rise over the coming quarters, impacting in particular middle market companies.

3. Lend to firms with low leverage and high interest coverage ratios: Lagged effects of monetary policy are slowing consumer credit growth with auto and credit card delinquencies rising and bank lending conditions tightening, leading to a significant slowing of loan growth impacting consumers and firms with weak balance sheets.

A Mild Recession Could Create Opportunity

Frances Donald, Global Chief Economist, Manulife Investment Management

Hopes for a soft landing may be growing, but we continue to believe that the U.S. economy will slip into a mild to moderate recession within the next six months. Simply put, we expect to see two consecutive quarters of negative GDP growth, accompanied by a rise in the unemployment rate.

Instinct might suggest this classifies as out-and-out bad news for investors, but we think it’s worth questioning whether that’s necessarily true or does it have more to do with how we’re conditioned to viewing the economy through binary lenses: growth (good) versus recession (bad)? As long-term investors, we think this “recession or no recession?” framing is unhelpful at best and, at worst, can stand in the way of investment returns. Instead, a more thoughtful approach is needed.

The Case for Peak Rates in Canada

Avery Shenfeld, Chief Economist, CIBC Economics

There are now more quarters and loonies piling up in savings than was the case prior to the pandemic as a share of income. That’s a key reason why the Bank of Canada should be setting aside the notion that further rate hikes are necessary to cool economic growth and thereby contain inflation.

…

A more cautious household sector, and the resulting hit to spending patterns, justifies a pause on rate hikes in Canada and perhaps in some overseas economies, even if the Fed continues to deliver another hike this year. Inflation isn’t cured in any of these major industrialized economies. But in a Canadian economy that started the year in excess demand and a tight labour market, we shouldn’t have expected inflation to melt away after only a few quarters of sluggish growth. We’ll need more such quarters, and the resulting increase in slack in the labour market, for the disinflationary impacts of a higher rates to show up. But those accumulating pennies saved, and pennies not spent, are a signal that interest rates are already high enough to work their magic, and it’s far too soon to decide that inflation will be sticky once the economy sees the further softening ahead.

In case you missed it:

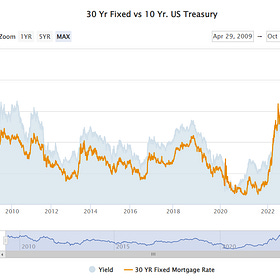

How Treasuries Could Return 74.7%

The Average Joe is Miffed The benchmark 30yr US mortgage rate hit 8% today. This is the rate for cream of the crop borrowers. God help you if you have bad credit and need to borrow money. While those who locked in rates in 2020 or 2021 are doing OK, nobody wants to borrow new money at these rates. Consequently, the market for home purchases has effectivel…