Stocks and bonds have rallied over the past several weeks (S&P 500 up about 15% since October 27th low) as expectations around inflation and interest rates improve.

The FOMC’s dot plot (released on Dec 13) points to the median expectation of 75bps in rate cuts next year. Dovish comments by Fed Chair Powell underscored the rally in yields preceding last week’s FOMC meeting as inflation’s trajectory continues downward.

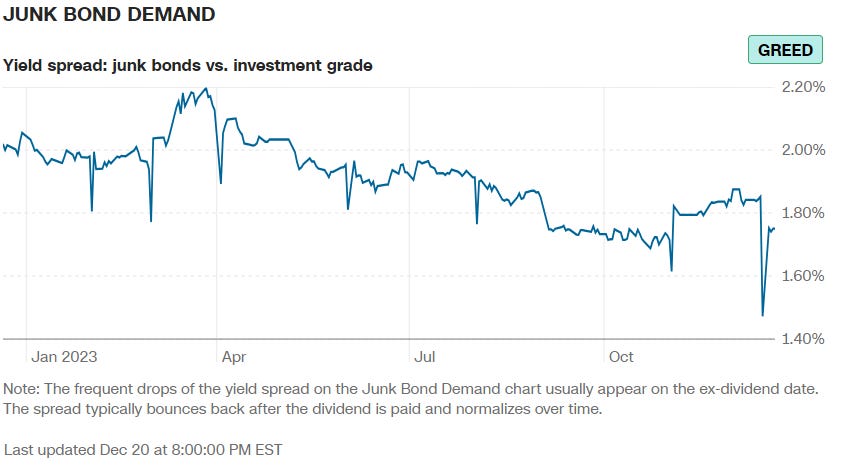

While this eases pressure on financial conditions, and creates an incentive to move assets out of money market funds into long-term assets, the recent rally may be too hot. Several sentiment indicators, shown below, suggest the market is currently extremely overbought. I wouldn’t be surprised if we saw a pullback in the markets over the next couple weeks.

(Charts source: CNN)