Calendar Year Asset Class Returns

Anyone else surprised to see bitcoin consistently at the top?

What to Expect for Next Year?

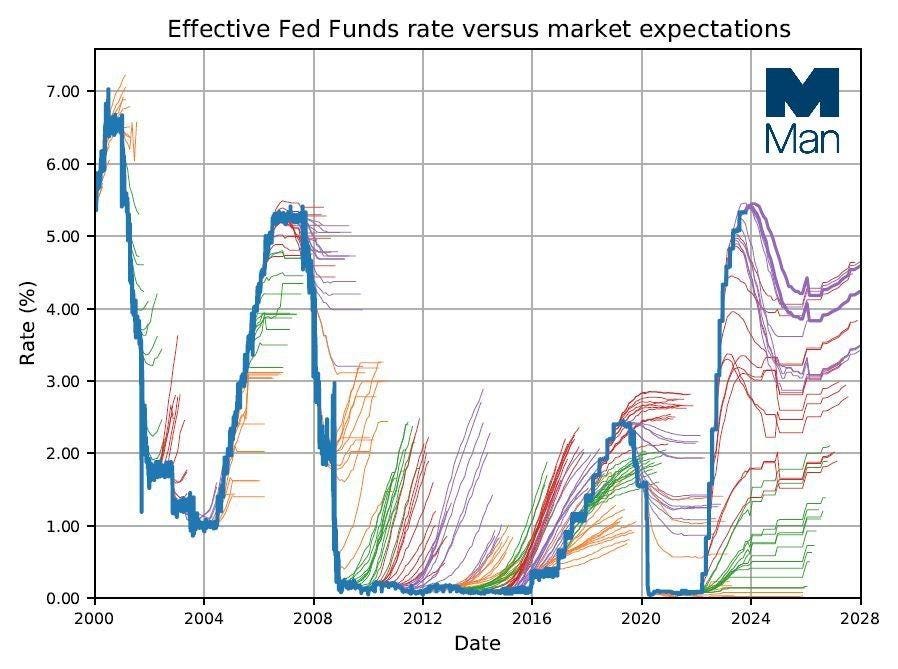

The chart below compares forward expectations (thin lines) vs actual Fed Funds rate. This chart demonstrates that forecasts are consistently wrong.

Right now, FOMC participants are anticipating 75bps of rate cuts in 2024 and a continued decline in inflation. That news (shared Wednesday in the Fed’s dot plot, along with Powell’s dovish statements) is bullish.

As we enter 2024 with this optimistic sentiment, it’s important to remember it could all change within a couple months. With that said, if policy rates do decline investors will think twice about leaving money in money market funds or term deposits. A scramble to avoid re-investment risk could further fuel the rally in longer duration bonds and equities.

Morgan Stanley Top 10 Surprises for 2024

Surprise #1: The elusive US hard landing arrives in style. Fiscal policy accentuates the long and variable lags of monetary policy – both having delayed the start of a US recession in 2023 and making it worse when it arrives in 2024 – prompting the Fed to move "expeditiously" back to neutral.

Surprise #2: Fed cuts 8 times, amid soft landing The Fed focuses on keeping real rates stable to lower as inflation falls. Duration rallies, and the curve flattens vs. forwards, with strong demand for long-dated Treasuries.

Surprise #3: QT ends before the first cut. A deterioration in dealer balance sheet capacity, a higher structural demand for reserves, and/or ongoing bank liquidity needs lead QT to end before the Fed cuts in June.

Surprise #4: BTP/Bund marked tightening into 2024 The diverging paths on supply and PEPP QT call for wider BTP/Bund spreads. We study what could be behind a BTP/Bund spread compression back to early 2022 levels.

Surprise #5: EUR 10s30s bull-flattens We estimate the impact of a sharp deterioration in the macro picture on 10s30s. The slope could return to ~50bp, which would imply a ~30bp flattening from current levels.

Surprise #6: An earlier-than-expected BoE pivot While the BoE is seen as a potential laggard in easing, the recent momentum in inflation and economic data might support a BoE pivot earlier than expected.

Surprise #7: The JGB curve steepens instead of flattens Consensus expects the JGB curve to flatten once the BoJ enters a normalization cycle. The curve could steepen if the BoJ were to signal to proceed gradually.

Surprise #8: Window for GBP gainsAn exceedingly low bar for economic data, in addition to cheap asset valuations, and the possibility for increased UK-EU economic cooperation provide the basis for a potentially bullish GBP.

Surprise #9: Drop in Australia and Canada r* pricing Medium-term rate expectations decline below their recent averages due to sluggish productivity, lower trend growth in China, and risks to commodity prices.

Surprise #10: Breakevens revert to 2019 levels TIPS breakevens return to pre-pandemic levels. 5y BEs and the 5s30s BE curve normalize to their 201319 averages of 1.75% and 20bp, respectively, leaving 30y BEs at 1.95%.