The poster boy for AI is set to release earnings later this week. As a heavyweight in many indices, NVIDIA’s release could move the market. I’m not saying I expect anything but stellar growth, but this stock is priced for perfection right now. A slight disappointment could knock it down a peg or two.

As the saying goes, the people who make the most money during a gold rush are the ones selling picks and shovels to the prospectors. NVIDIA sells the backbone to many AI systems and its chips are in high demand. It’s a good company with a great product. However, so was Cisco in the early 2000s. Similar to NVIDIA, Cisco sold critical infrastructure for the internet boom. It WAS the internet.

Remember this commercial from 1999?

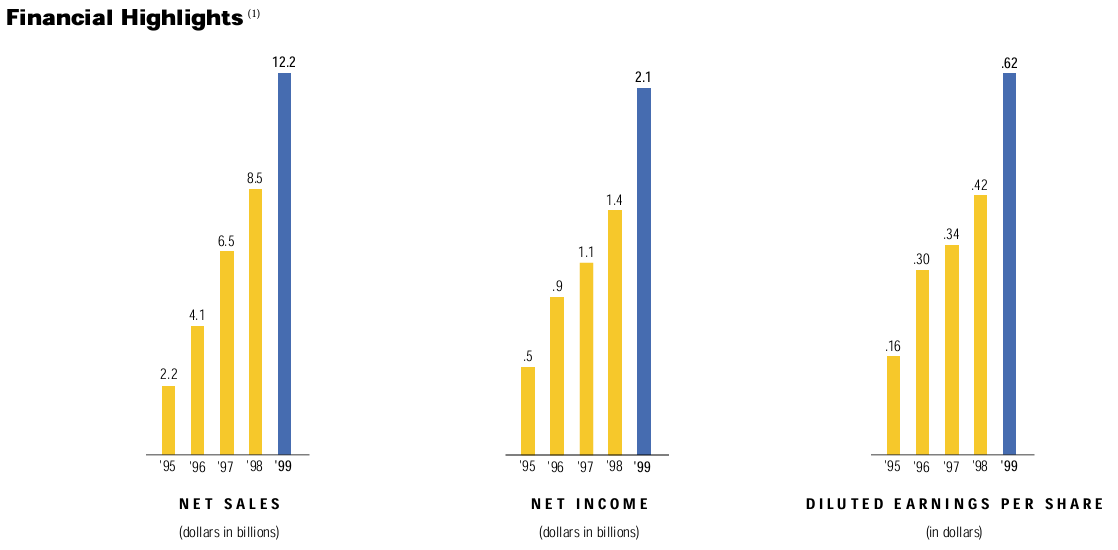

Cisco was the industry leader growing at a pace rivaling today’s industry leader: NVIDIA.

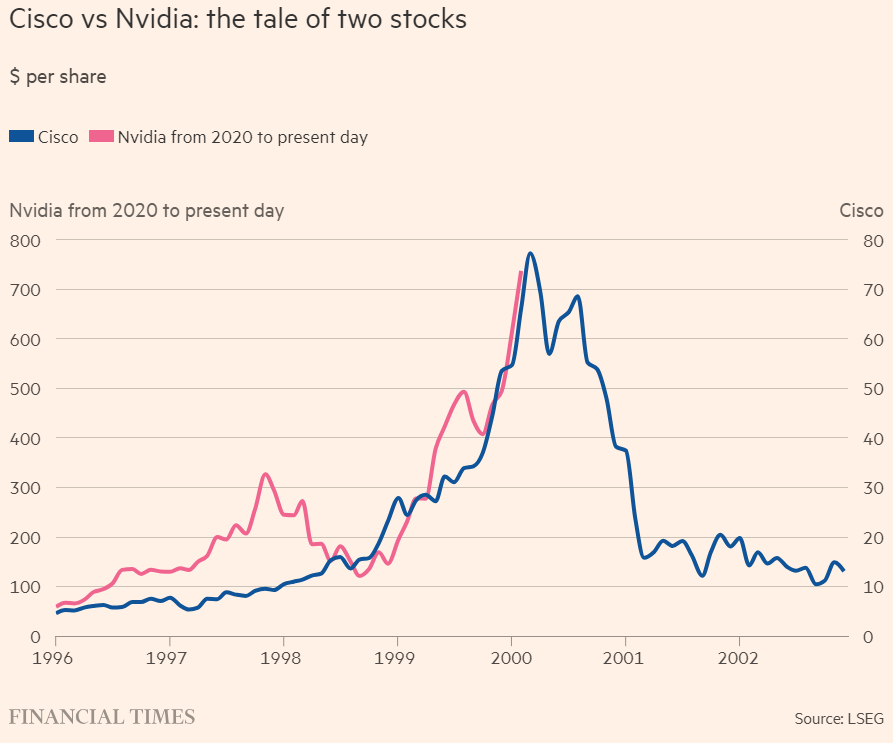

This revenue and earnings growth launched Cisco’s stock price, much like NVIDIA’s today.

However, after 2000, Cisco’s share price collapsed along with many other high-flying tech stocks.

A generation has passed, yet someone who bought at Cisco’s 2000 peak is still underwater.

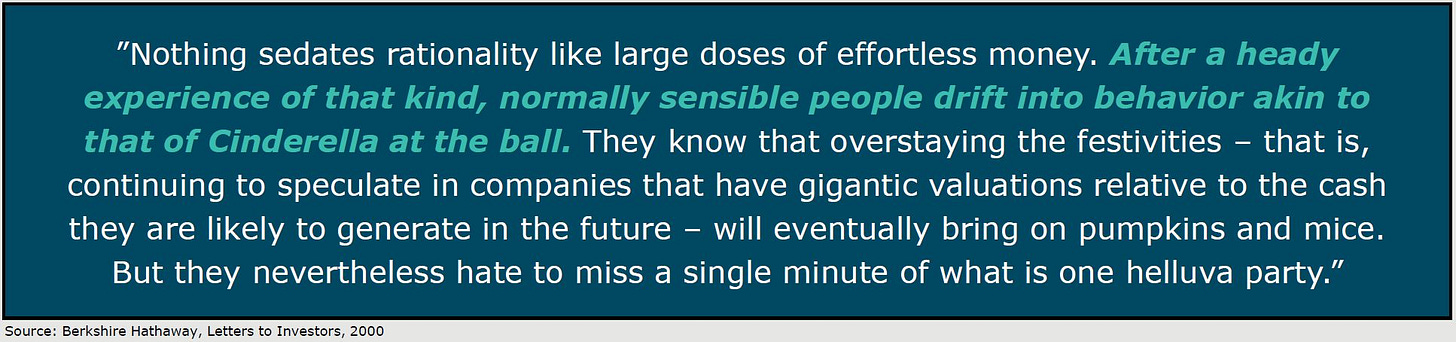

Don’t get me wrong, Cisco is still a good company that makes a lot of money and provides an important product. It simply wasn’t worth what people were paying back in 2000.

Post collapse, while the survivors of the tech capsize scrambled to shore, the value-added players took the reins from those providing the infrastructure. Amazon, Google, Apple…companies that leveraged the capabilities of the internet took over from companies that built the internet.

I suspect we may eventually witness the same thing with the AI boom.

Of course, this is just my opinion and I could be wrong. Or I could eventually be right but not until after AI stocks continue booming for some time. So don’t take this as investment advice.