Portfolio is Second Biggest Lifetime Expense

Simple tips to save hundreds of thousands of dollars

Next to a roof over your head, your investment portfolio is the second most expensive purchase you’ll make in your lifetime.

The chart below estimates portfolio costs, assuming a conservative $2000 annual contribution that increases 10% each year. A portfolio with a 2% and 1% fee would cumulatively cost $627,878 and $347,630 respectively in fees. That averages to $15,697 annually for the portfolio with a 2% fee. $8,691 annually for the 1% fee portfolio.

This is a example for an average person making reasonable contributions. Someone with more wealth would obviously pay more.

A 2% all-in cost is not unheard of. 1% for the advisor and 1% for the company managing the funds in the portfolio.

Is the investor really getting $8,691-$15,697 in value from their advisor and fund managers each year? I doubt it.

First of all, the management fee for actively-managed funds is an unnecessary expense.

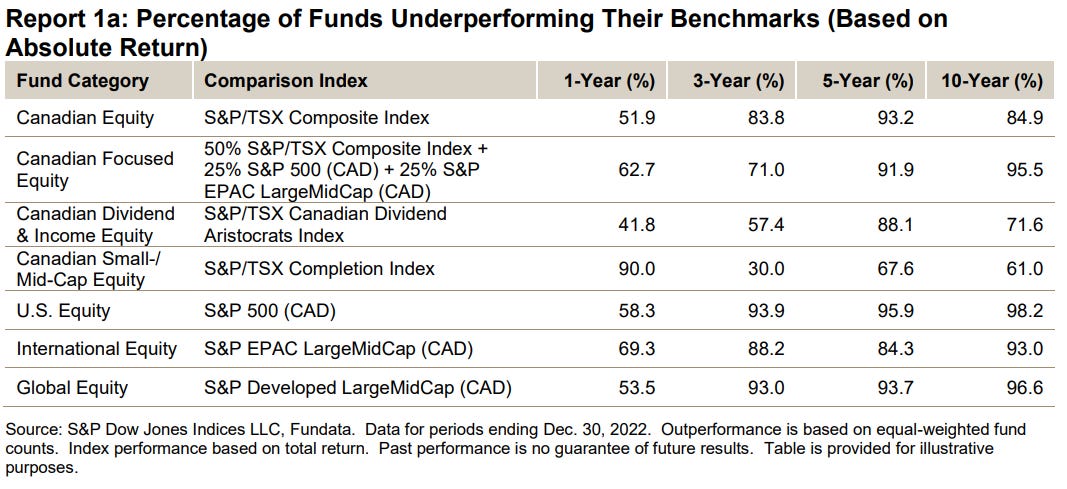

Most active managers underperform their benchmarks over the long run (see charts below). For example, in Canada 93% of managers underperformed over a 5-year period. Instead of wasting money pursuing unattainable outperformance, investors should work with an advisor to construct a portfolio that provides diversified market exposure (i.e. Beta) using dirt-cheap index funds. By doing this, investors can cut management fees from 1% to about 0.10% or even less.

The other half of the 2% cost is the 1% taken by the advisor each year. To cut this expense investors should switch to a fee-for-service (i.e. paid by the hour, not as a % of assets) advisor.

Assuming the ‘know your client’, reporting and portfolio construction process requires 5-10 hours per year, at $300 per hour that’s $1,500-$3,000 per year. This is a $5,691-$7,191 savings each year.

By switching to low-cost index funds and using a fee-for-service advisor you could be looking at roughly a $570,000 savings during the average person’s wealth accumulation period.

Bottom line: 1% or 2% might not sound like much, but when applied to the total value of your portfolio over the entirety of your investing time horizon you might be throwing hundreds of thousands of dollars down the toilet. Investors can achieve the same professionally-advised outcome by choosing a fee-for-service advisor and using low cost index funds.