The decision to pay off (or pay down) your mortgage vs. invest is not as simple as many think. It’s part math, part psychology and part risk-management.

While many professionals will confidently argue you’re better off investing, you must remember these people get paid more if you own a stock portfolio and a mortgage. These products are big bucks for advisors and banks, so it’s not in their best interest to tell you to sell your portfolio and use the proceeds to eradicate debt.

Putting conflicts of interest aside, the most common answer is to compare your mortgage rate to your expected returns. If the mortgage rate is lower, then the argument is you should invest. However, there are flaws in this comparison.

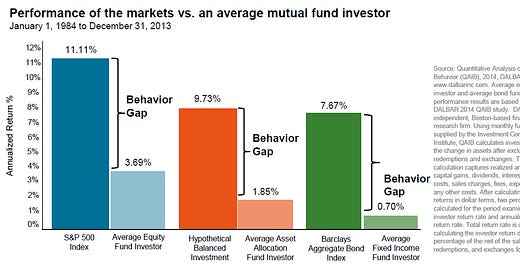

All returns should be evaluated based on the range of probabilities you achieve that return. A guaranteed steady annual 5% return has a higher risk-adjusted value than getting 10% one year, 0% the next, and so on (while still averaging 5%). Your mortgage rate never fluctuates so it’s similar to a ‘guaranteed return’. Whereas, the returns on a stock portfolio will vary widely from year to year. For those who can invest for a long period and ignore the variation, the math might work. However, reality is many people panic-sell during bear markets and panic-buy during bull markets, achieving returns far lower than the market average.

Another consideration is liquidity. If you use all your liquid assets to pay down debt you’re left with potentially inaccessible capital that you might need in a pinch, for example if you lose your job. You can open a home equity line of credit (HELOC), potentially alleviating this risk, but theoretically the HELOC can be closed or reduced by the lender right when you need it most. Of course, by paying down your mortgage your monthly cash outflows (and thus liquidity needs) are reduced but you still have bills to pay. Before making a decision, you should compare your cashflow needs today vs after paying down the mortgage.

A personal liquidity crisis is most likely to occur during a bad economy - when you’ve lost your job, stocks are tanking and the real estate market is seizing up (like today!). So while your publicly-traded stock portfolio is liquid, the value might have declined by 25% right when you need it. You’re forced to access that liquidity when it’s worth less and sell just when you should be considering buying.

To mitigate a personal liquidity crisis I keep a true emergency fund (cash and cash-equivalents) so I’m never forced to sell something I don’t want to sell. Really, everyone’s first personal finance priority should be to build an emergency cash reserve for a rainy day. Ideally, enough to cover expenses for 6-12 months.

“Everyone’s first personal finance priority should be to build an emergency cash reserve for a rainy day.”

Another consideration in your decision is the psychological cost of not paying down your debt to invest. Many people feel a great sense of relief when their mortgage is paid off. Debt is a burden that follows you everywhere. For many, the math is of lesser concern.

Now imagine the psychological cost if you had the opportunity to pay off your mortgage, but instead invested the money and subsequently lost 25%. How would that make you feel? If this would bother you, it should be factored into your decision.

My personal strategy

Over the years I made the effort to pay down my mortgage faster than the bank would like, but not by making lump sum payments. Instead, I increased my bi-weekly payments any time my pay increased. I had a lump sum of cash available, but preserved it by deploying pay increases towards my debt instead.

By slowly cranking up my payments over time the extra cash outflow wasn’t really noticeable. Eventually I was doubling my original payments and it was no big deal.

If I ever lost my job I could always tap into my emergency fund and scale back mortgage payments to the original level to reduce cash outflows. This strategy took longer than if I had made a big lump sum payment, but it provided me the flexibility and security I desired.

Do you know anyone who has paid off their mortgage and regretted it? Comment below.