Tech Stocks Hitting Bubble Territory

Tech valuations are stretched to levels not seen since the 2000 internet bubble. Remember how that ended?

Two things that have worked for investors so far in 2023: Tech stocks and cash.

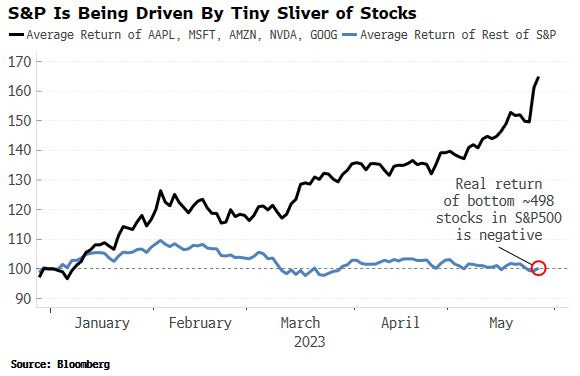

Below are a couple charts illustrating returns for various indices. Year-to-date the NASDAQ has outperformed the industrials-heavy DJIA by about 24%! This is huge, especially considering the Dow is negative so far this year. The broader market (S&P 500) is up 8.86%, but that’s because of a handful of tech names.

After removing Apple, Microsoft, Amazon, NVIDIA and Google from the S&P 500 the index is actually negative YTD 2023.

Narrow market leadership and massive performance divergence points to an emerging bubble in the tech space. While I believe we may be at the precipice of a secular productivity boom created by the integration of AI into many business processes, it seems like the market is getting ahead of itself.

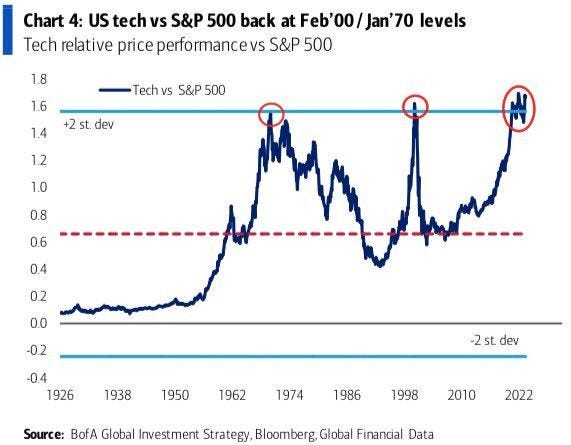

Tech valuations are stretched to levels not seen since the 2000 internet bubble. Remember how that ended? Not good.

But isn’t AI a massive opportunity? Yes. Bubbles are built off real opportunity. One could even argue that bubbles are beneficial to society because they fund the rapid deployment of new technology.

The early 2000s tech implosion didn’t mean the Internet wasn’t productivity-enhancing. Like bubbles that preceded it, capital inflows that created the overvaluation laid the infrastructure for future growth.

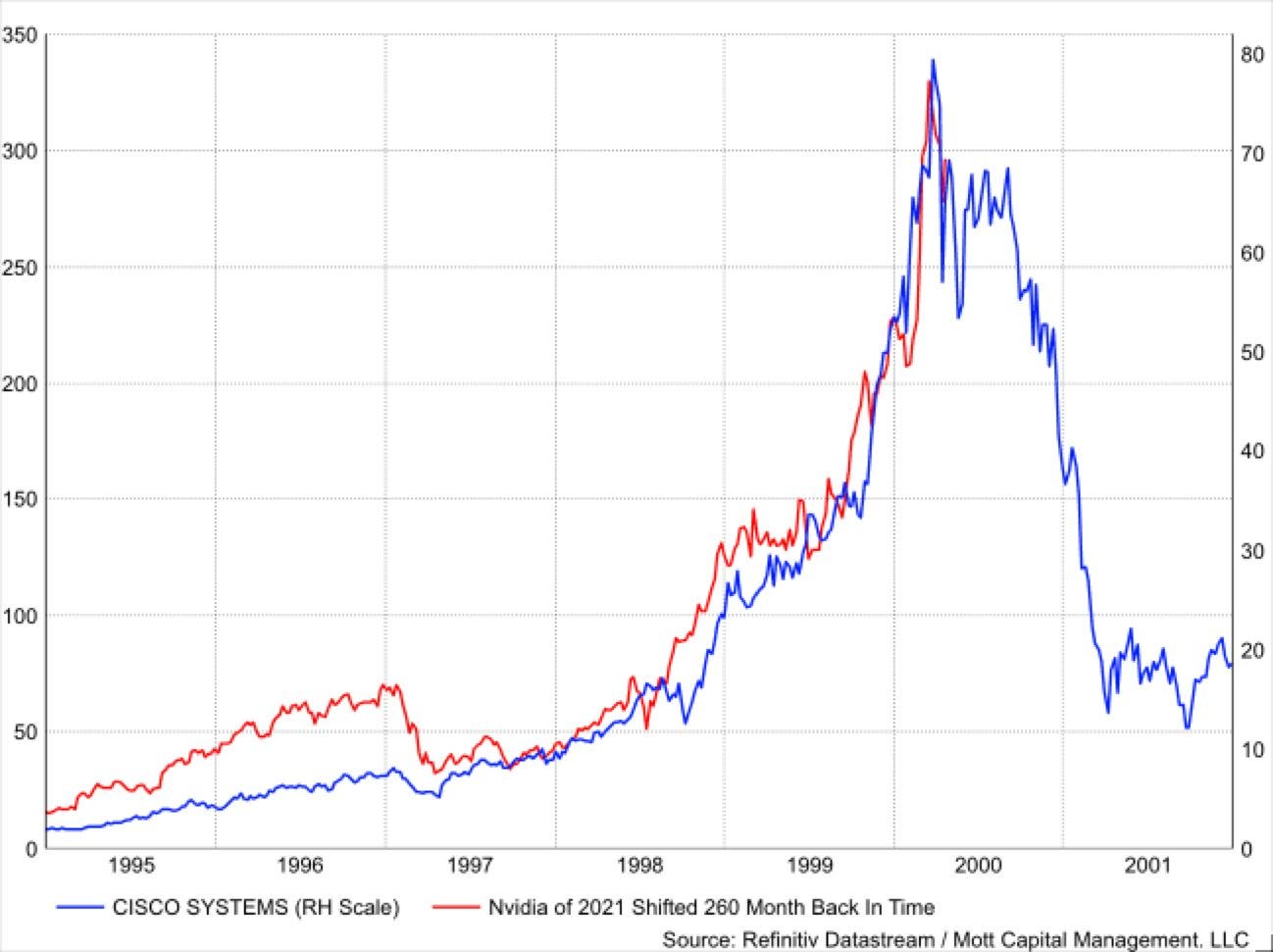

Today, capital is flowing to tech companies involved with AI. While this money helps fund development it is expanding a bubble that will someday pop. Of course, overvalued stocks could get even more overvalued so it’s impossible to know how long this will last.

Weren’t tech stocks in a big bear market just a few months ago? It seems too quick to call a bubble, but the valuations speak for themselves. Perhaps this time is different? Famous last words, but one has to consider that earnings could rapidly catch up to support prices. If that happens this could continue for a while.

In contrast, the bubble that burst in the 2000s was built off companies with questionable business models, negative cash flows and no path to profitability. Also, by the time it collapsed, EVERYONE and their mom was buying tech stocks. The current bubble hasn’t had the time and exposure to draw in the greater fool.

Not yet, anyways.