The Contractual 8.5% Return

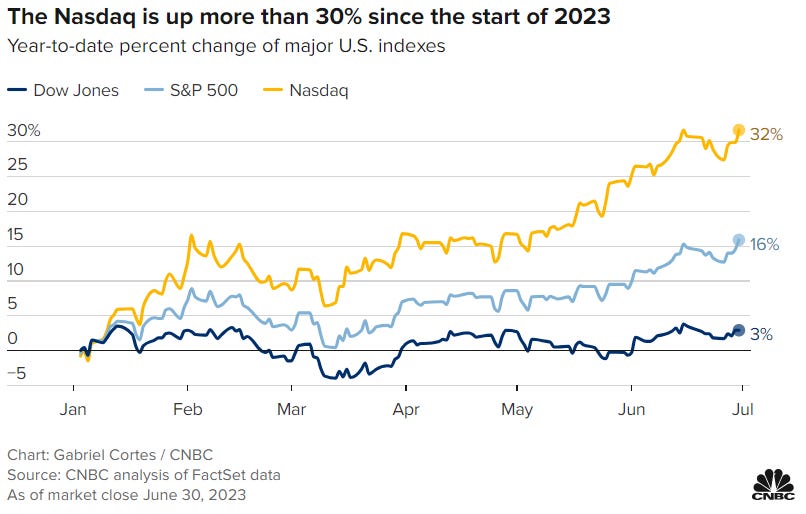

Plus: Nasdaq ends quarter up 32% YTD

As of today’s close, the Nasdaq is having it’s best year since 1983.

The Contractual 8.5% Return

Right now, high yield bonds are yielding almost 8.5%. That’s some healthy competition for stocks which have typically returned between 8-10% annually, depending on the time period.

Yield doesn’t necessarily = return, but it has historically been a strong indicator of forward returns. If held to maturity, a bond and its re-invested coupons should provide a return close to its yield to maturity.

This doesn’t necessarily mean companies are paying 8.5% directly to bond holders, however they are contractually obligated to pay the coupons (which could vary from the yield) and principal amount used to calculate that yield. Any company that misses a single payment goes into default and enters a world of pain.

When a company defaults on its debt, the terms and conditions (aka covenants) of the bond contract are triggered. This could mean that effectively bond holders become owners of the company, wiping out shareholders. A default also threatens current and future job prospects for the board and executive team. It’s a big deal.

Ultimately, a default often doesn’t mean a company is fully liquidated. Instead, the capital and operational structure of the company may be reorganized. A leaner, meaner company might emerge out of bankruptcy with bondholders recovering a portion of their original investment and possibly becoming shareholders.

Consequently, when investing in high yield bonds, you can’t only look at the yield to maturity. Defaults are an important risk consideration, but a lot of that risk can be diversified away.

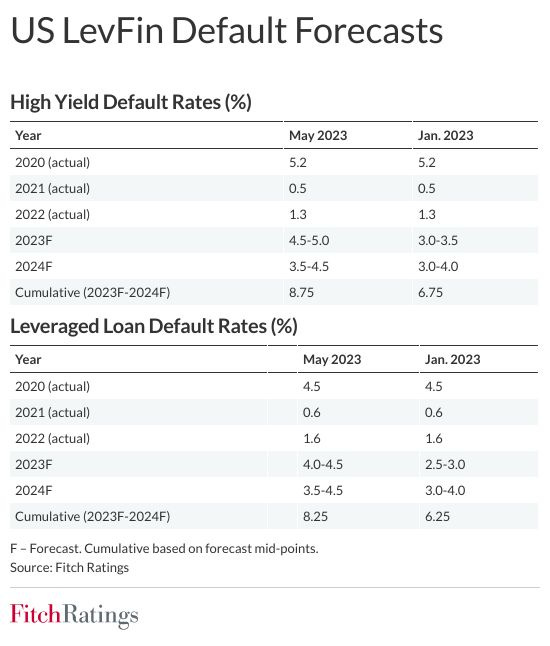

Historically default rates have averaged around 3.1%. However, looking to 2024, default rates are predicted to rise as corporate cash flows come under pressure (due to recession) and bond issues get rolled over at higher rates. Fitch Ratings and Standard & Poors both see default rates reaching between 3.5% and 4.5% in 2024.

Using history as a guide, default rates have on occasion risen much higher than the ratings agencies are forecasting for 2024. Also, it’s important to remember that the default rates across sectors don’t all rise in tandem. Often, the aggregate market default rate is pulled up by a particular sector of the economy, such as energy in 2016.

As I alluded to earlier, default doesn’t necessarily mean investors lose everything. The 25 year average recovery rate on defaulted debt is 40.5%. Combine the default rate and recovery rate and you end up with a muted impact to the yield to maturity for a diversified high yield bond portfolio.

Long-term investors holding high yield bonds could end up receiving high single-digit total returns. Of course, the journey could be rocky (aka losses) if defaults accelerate beyond expectations, liquidity dries up or yields rise much further. Also, the longer yields remain elevated the more stress experienced by corporations renewing or issuing debt. In a recession, spreads could blow out and that 8.5% yield could become an 11% yield - along with associated price declines.

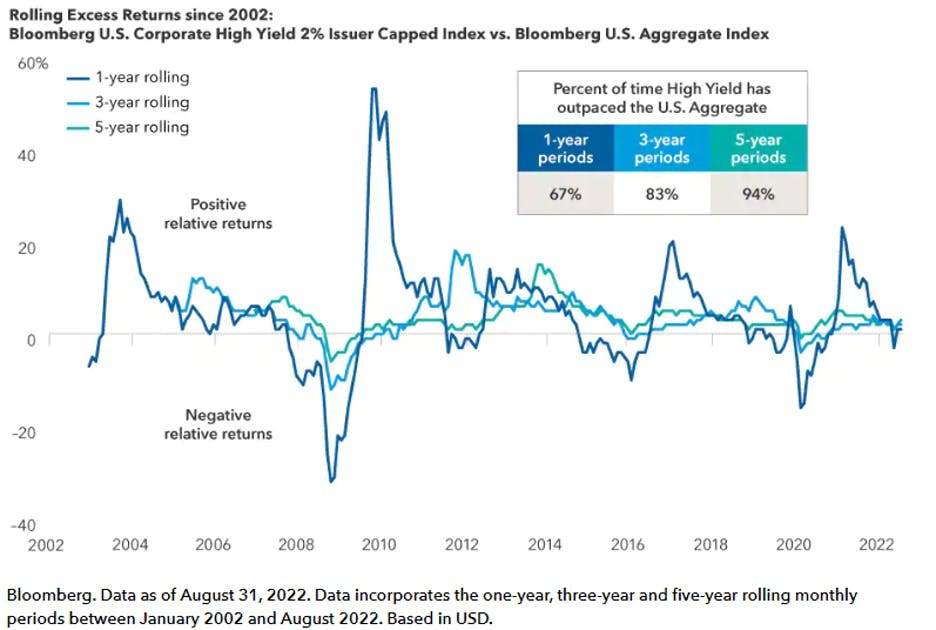

I like to look at high yield bonds using a risk spectrum, on which they fall somewhere between investment grade fixed income and equities. Bonds rank higher in a company’s capital structure and are therefore lower risk than stocks. Of course, high yield bonds have less upside potential than equities.

On a risk-adjusted basis, I think high yield debt offers a compelling way to add risk exposure without diving head-first into equities. Is now the right time? Who the fuck knows. But that’s why you don’t blow all your gunpowder on a single trade.