If A Recession is Coming Why is the Market Still Rising?

The Bulls are Winning - DJIA up 700 points

Welcome! I'm Sarah Connor and this is my investing newsletter. You can subscribe by clicking on this handy little button:

Now let’s get into it…

What drives stock market returns?

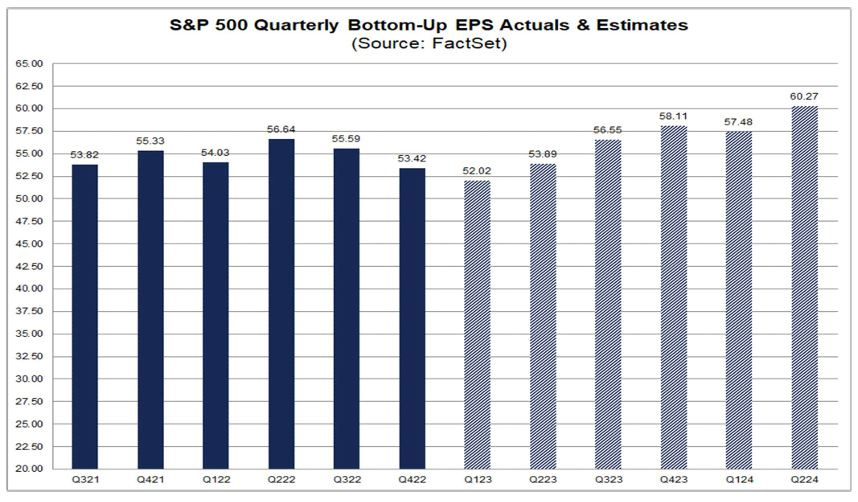

It’s simple. Earnings drive stock prices, and earnings estimates have not declined to any meaningful degree.

In fact, if forward estimates as provided by FactSet are correct we could see a record quarter in Q4 2023.

Where is the recession that everyone’s been calling for the past 18 months?

The bearish case is no mystery, yet jobs numbers keep blowing out estimates. In May the US added 339,000 jobs beating the Dow Jones estimate for 190,000. This is the 29th straight month of positive job growth.

Sure, you can pick the data apart to uncover a reason for pessimism. The fact is the market loves what’s going on and has rallied since October 2022. Today the DJIA rallied another 700 points.

The bears get off on searching for the next shoe to drop and pointing out that the good news isn’t real. For example, they’ll argue that the rally isn’t real because it’s being driven by a handful of stocks. Well, the chart below shows why this isn’t a concern. On average the S&P 500 rallied over 22% during the 12mths after a highly concentrated rally.

Look, I get that there are tons of fantastic reasons to be bearish, but the market is telling a different story. So I’m listening. I’m still cautious (I am always cautious…it’s in my nature) but my mind is open to a new narrative.

I’ve seen this before coming out of the Global Financial Crisis and Covid crash. People hate to believe the worst might actually be behind them. They get PTSD and fall in love with the bear case. The bears always sound smart.

Perhaps the market is looking through any economic malaise brought on by higher rates and sees an emerging productivity boom and disinflationary pressures.