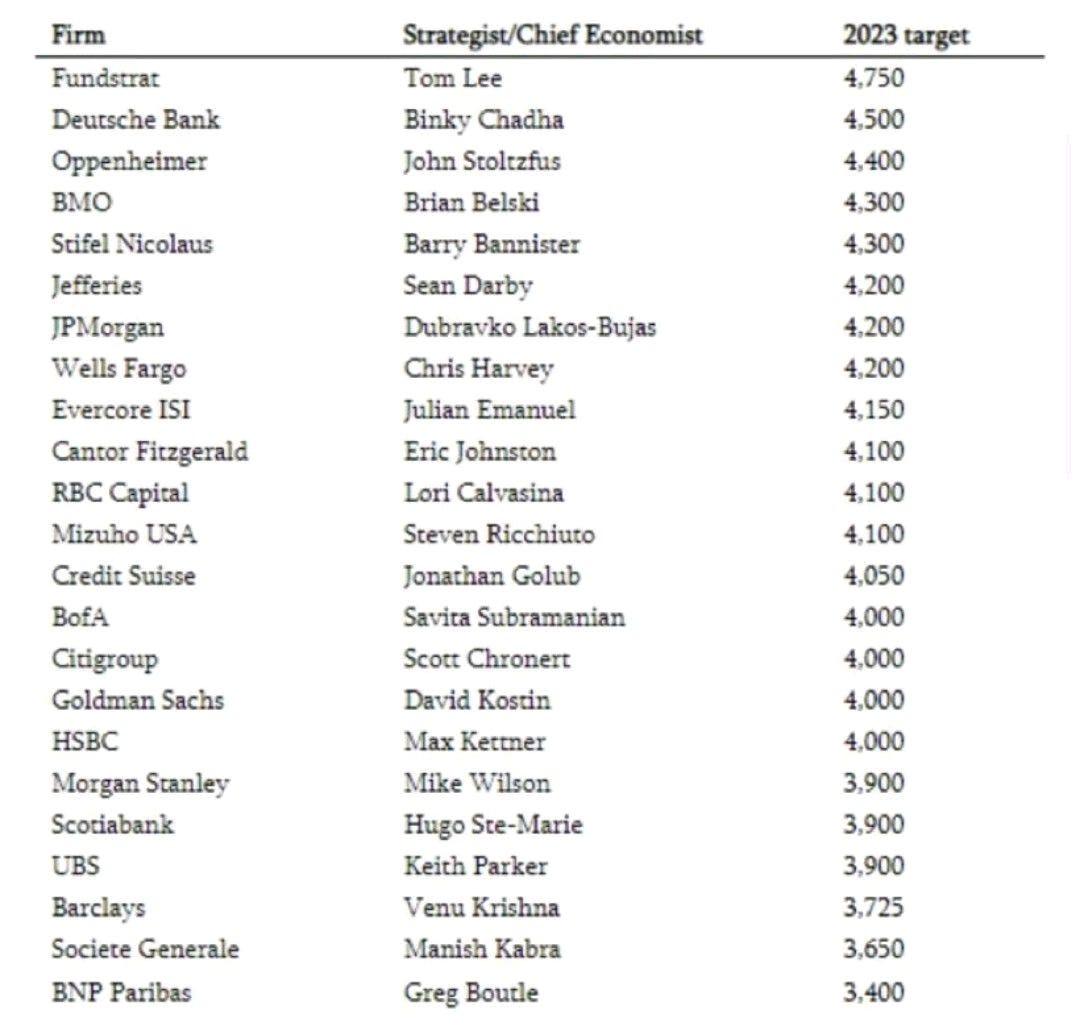

It’s January 1, 2023 and the investment strategists are rolling out their year-end forecasts for the S&P 500.

As you see below, most are forecasting a gain for the year. Considering the market is up about 80% of years, forecasting a gain doesn’t require much intestinal fortitude. Indeed, straying from the crowd to predict a down year is like betting against the house at a casino (which everyone invariably does when they gamble). Instead, repeatedly predicting up-years is an easy way to be right 80% of the time. A great career move, but ultimately meangless for investors.

Rather than their 2023 forecasts, last year’s predictions are more telling. The second table below shows analyst 2022 forecasts that ended way off the mark. These 2022 forecasts were made around the end of 2021. At that time, inflation was rapidly rising, valuations were stretched and rates had nowhere to go but up. Despite the obvious signs that the punch bowl was about to be removed, strategists were still doggedly bullish.

I’m not here to pick on anyone. I am simply pointing out that most forecasts aren’t worth the paper they’re written on. S&P 500 targets make great headlines, but the real value is in how the strategists arrived at their forecasts. Personally, I ignore the forecast but listen intently to the thought process.

How did the markets perform in 2022?

I’d sum it up by saying the closer an asset was related to technology, the worse it did - obvious victims, Bitcoin and Nasdaq, fared the worst. With a heavy weight to FAANG stocks, the S&P 500 also suffered one of its worst calendar year declines ever.

Notably, gold (the ultimate anti-tech play?) performed quite well by retaining its purchasing power amid a strengthening dollar. Held in almost any currency other than the US dollar, gold was likely a top performer in many non-US domiciled portfolios.

If you’re down for the year, you’re in good company. US banks are sitting on paper losses in the hundreds of billions.

Loan books are also looking a bit stressed too (obviously not all of this is held by banks).

Happy new year!