Word on the street

Atlanta Fed President Raphael Bostic to the Atlanta Rotary Club today:

On Fed policy: “We are just going to have to hold our resolve.”

Asked by the moderator how long he saw rates above 5%, Bostic said: “Three words: a long time.”

Here’s the full speech:

The link between earnings and stock prices

Why do equity markets decline? It’s simple: Earnings.

The fair value of equity prices is estimated by discounting future free cashflows to equity owners into the present, using a discount rate that captures the cost of equity. With some adjustments (e.g. non-cash items like depreciation), cashflows are related to accounting earnings. Over the long run, cashflows and earnings should have a reasonable degree of correlation. Higher expected future earnings should also mean higher expected future cash flows, causing stock prices to rise, all things equal.

It is no surprise then that major bear markets are accompanied by big earnings declines.

Today, earnings expectations are in a downward trend. So far the decline is only around 5-7% from the peak, but after adjusting for inflation the decline is probably more like 10-14%, depending on where inflation lands over the next year. The downward revisions are likely to persist, given recent broad economic data.

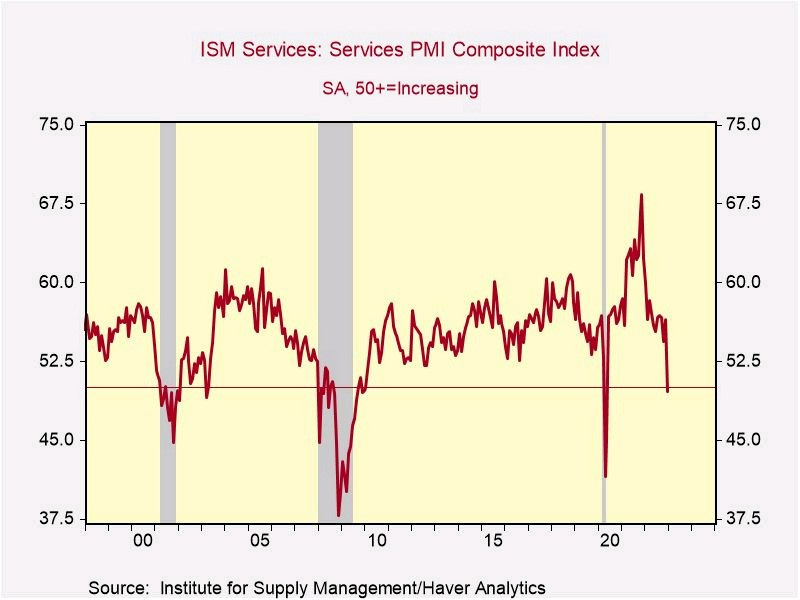

The earnings picture may continue to erode as both manufacturing and services PMI remain below 50 (contraction territory). Indeed, services PMI - which has held up over the past few months - plummeted by 6.9 percenetage points in December.

With both manufacturing and services sectors of the economy contracting, it is reasonable to expect corporate earnings and cashflows to decline further.