When Diversification Fails

Don't let another 2022 or 2008 kill your portfolio

“Diversification” is often misunderstood by investors.

In theory, diversification occurs when assets are combined to produce a lower risk profile than any of the individual assets alone.

Intuitively, diversification makes sense.

A farmer that grows two or more crops is less likely to experience total loss (due to pests, etc.) than a farmer that only grows one. The general qualitative concept is that when one thing doesn’t work something else will.

Quantitatively, diversification is elegantly summarized by the following formula. Unfortunately, reality isn’t as elegant as the math.

Mathematically, by combining assets with low/negative correlations an investor can lower portfolio risk (measured as standard deviation). Individually, the standard deviations of each asset may be higher than the standard deviation of the combination of assets. The mathematical result is a portfolio with less variability of returns.

A simple example is the combination of stocks and bonds used to construct the traditional 60-40 portfolio. The construct is driven by the historically low correlation between stocks and bonds.

Similarly, spreading exposure across a variety of issuers within an asset class (e.g. stocks) helps to minimize idiosyncratic risk. When one company is performing poorly due to business-specific reasons (e.g. mismanagement), others might be doing well.

(Note the emphasis on idiosyncratic risk. As we will see later, a 30-stock portfolio may have effectively diversified away business risk, but not market risk.)

While I don’t disagree with the fundamental premise of diversification, I believe it is misunderstood, leading to unexpected outcomes like 2022 when both stocks and bonds declined.

The Concept of Diversification is Overstretched

I think we can all agree there are both the intuitive and mathematical benefits of diversification. We should strive to diversify asset exposure.

Unfortunately, the asset management industry has stretched this understanding to mean that more = better. So you end up with portfolios that are “diversified” by numerous categories such as manager, geography, investment style, industry sector, currency, asset class, and so on in an effort to squeeze every drop from the diversification lemon.

The reality is that many portfolio builders don’t understand risk and marketers love (irrelevant) proof points. Diversification has limits and more does not necessarily equal better.

For Office Space fans out there, we know that 37 pieces of flair is no better than 15. Yet, the unnecessary flair - even though it has no impact on performance - is held as the standard.

So while investors may be comforted by 37 types of diversification, the effect is negligible. Indeed, overstating the benefits of increased facets of diversification is downright dangerous because investors become complacent.

Diversification doesn’t protect against economic hurricanes

A farmer growing 5 crops (as opposed to 1) is protected from crop-specific diseases. This is where diversification works. However, all 5 crops are still exposed to bad weather. Crop diversification fails when a farm is hit by a hurricane.

This is a critical failure of portfolio diversification. We saw this play out in 2022 when both stocks and bonds declined. Why? Because both are exposed to the economic hurricane of dramatically rising interest rates.

It does not matter that a portfolio has 37 pieces of flair/diversification if all underlying assets are still exposed to a single factor.

While many will argue that these economic hurricanes are once-in-a-lifetime events, I’ve witnessed about five lifetimes of these crises in my 22+ year career.

What does diversification actually achieve?

The first step in the investment process is to understand an investor’s willingness to take on risk. Even if an investor truly understands their aversion to risk - a truth that is often masked - how do they define “risk”?

I believe most think of risk as a loss of capital. People think in dollar terms.

Diversification - in the mathematical sense - only reduces the variability of portfolio returns around the mean (standard deviation). Someone looking at their portfolio on a daily basis might observe the day-to-day fluctuations. However, most investors think in terms of how much money they’ve earned or lost over a given period of time. Given this, standard deviation is probably not an appropriate measure of personal risk.

Standard deviation doesn’t account for the direction and location of the mean. For example, in a long bear market the recent mean return might be negative. Variability of returns around that negative mean could be wide or narrow, but ultimately the market is in decline and investors are losing money. In other words, a security can have a low standard deviation and a negative return.

Also, standard deviation is a moving target - it changes over time. But portfolio analyses based on standard deviation assumes the future will resemble the past. Flawed from the get-go.

The entire mathematical premise of diversification is flawed

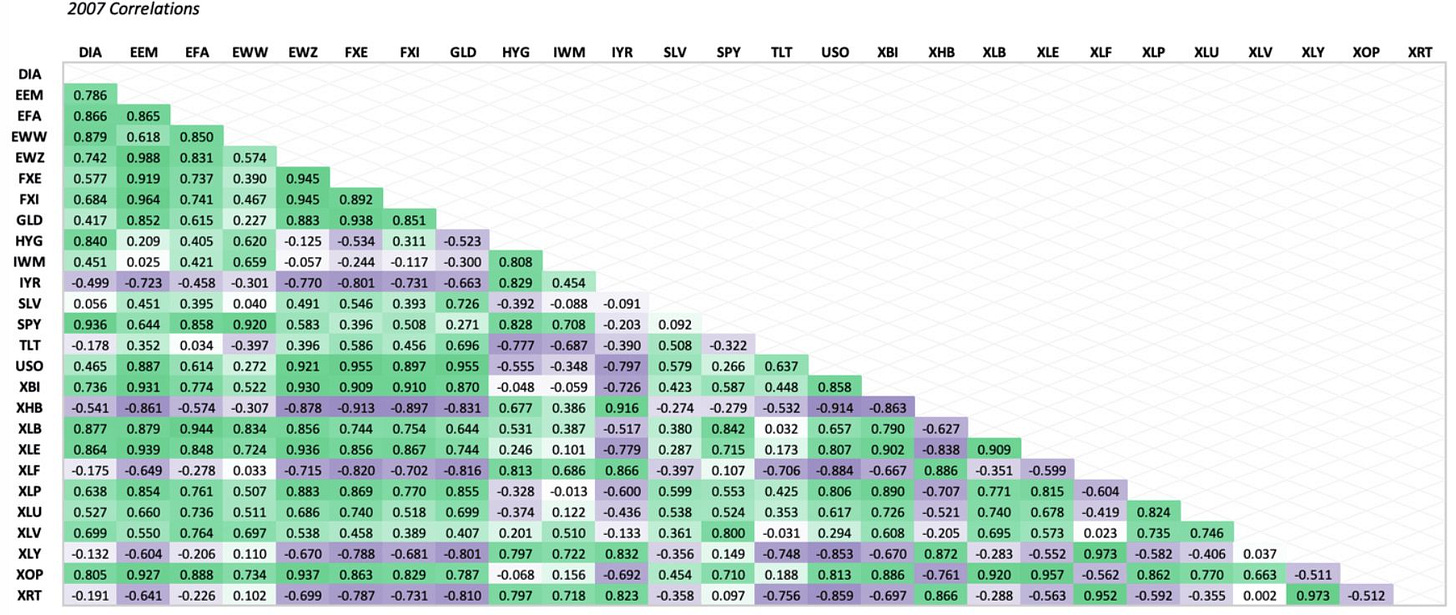

The two charts below compare correlations of various indices (using ETFs as proxies) before the Global Financial Crisis and during. You can see how within a year correlations shifted closer to one as market volatility rose.

A portfolio that was considered “diversified” in 2007 was actually not when crisis hit in 2008. The same thing happened in 2022 as both stocks and bonds declined due to rising rates.

Correlations change over time - sometimes quickly, sometimes slowly. Constructing a portfolio based on historical correlations might work for a while, but over time it is like building a skyscraper on sand.

My point is that - despite the comfort that a professional constructed and managed portfolio might elicit - diversification might not provide the risk-reducing outcome that investors actually desire.

This is particularly true if an investor’s definition of risk is “losing money”.

Investors don’t actually want diversification

Despite its limitations, diversification is still important.

It doesn’t make sense to invest an entire portfolio into a single stock. However, investors must understand that diversification comes with tradeoffs.

Putting 100% of a portfolio into Apple ($aapl) a decade ago would have provided a fantastic return. We know this in hindsight. A diversified portfolio, however, would have held many other assets - many of which didn’t perform as well as Apple.

A truly diversified portfolio will always include components that are underperforming. When investors see a slice of their portfolios falling behind they start to ask questions.

FOMO sets in, and with the benefit of hindsight they wish they put all their eggs in the outperforming asset. “Why didn’t we put all my money in Apple?” This is a tough conversation for financial advisors to manage.

Of course, nobody knows with any certainty what the next Apple will be. But many investors will extrapolate the past and chase historical returns.

Over time, this behavior leads investors to buy high and sell low, and is detrimental to long term portfolio health.

So how do you build a diversified portfolio?

The act of diversifying a portfolio isn’t as elegant as the formula suggests. Also, more facets of diversification doesn’t equal better diversification.

Robust portfolio construction must look beyond correlations and identify the economic and market factors that could similarly impact an investors assets, income and liabilities.

Easier said than done.

It's true. A well-diversified portfolio includes assets that are under-performing or experiencing volatility at various times. The response hinges (should) on each person's risk tolerance, investment goals, and time horizon. But also, the term "under-performing" can have different meanings to different people, despite what a balance sheet or graph might show. Sometimes, people just "like the stock".