11 Charts from the Past Week

Dollar decline, economic weakness, AI threat

But first a question:

Gentle Decline for the US Dollar

As the debt ceiling “X-date” approaches, all eyes are on Treasuries and the dollar. Although technical default remains improbable because the US prints its own money and is the global reserve currency, credit default swaps are pricing in more stress. We’ll probably see more politicking over the debt ceiling during the next few weeks, elevating concerns over the US fiscal situation and the dollar.

Lately, there is more chatter about the dollar losing reserve status. This is highly unlikely in the near term because there simply is no alternative. Not the yuan, not bitcoin, not some manufactured BRICs currency, not gold. No other market is deep and liquid enough to absorb capital flows from non-US trade surpluses.

Still, one can’t deny the slow and subtle shift in power. Over the past several years, the dollar has lost share in global trade.

It’s a minor concern for now. I’ll really start to worry when foreign central banks no longer need swap lines from the Fed during times of financial stress.

Yet Again, Fed is Behind the Curve

As indicated by the forward curve, markets are expecting a steep decline in rates through 2024. The Fed’s “Dot Plot” (i.e. committee member expectations) trails the market. In classic Fed style, it looks like they plan to keep rates elevated until something breaks. Then they’ll wonder what happened.

Just like the Fed was late to the combat inflation, they’ll be late to combat deflation.

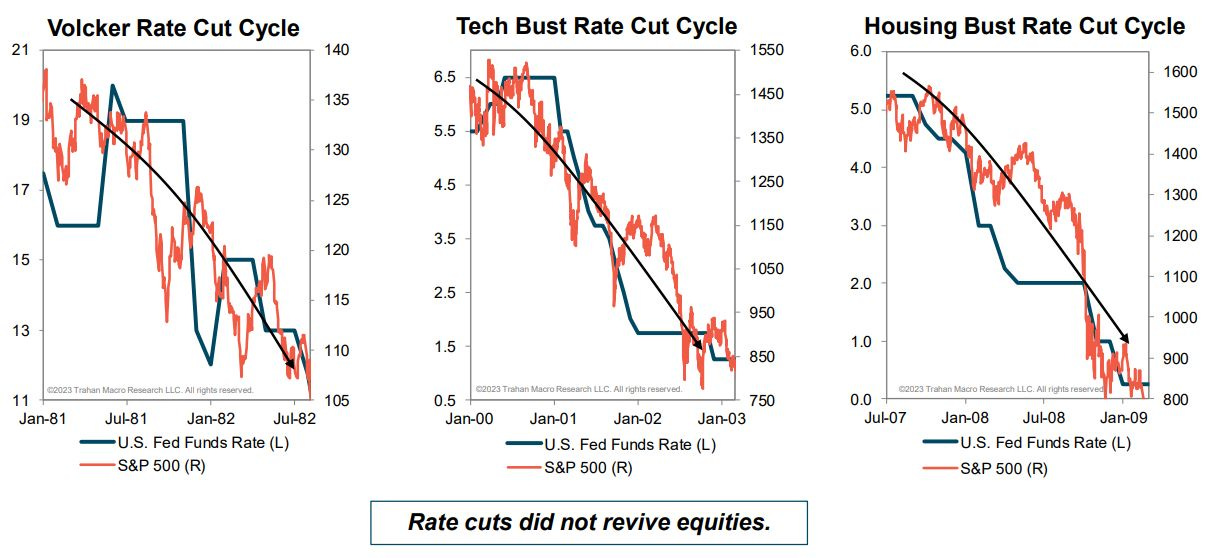

While the idea of declining rates might sound appealing to those holding variable-rate loans and blindly pricing assets only using discount rates, history shows that downward policy rate adjustments are typically a reaction to weakening economic conditions. During such periods, markets decline in tandem as cashflows erode and risk aversion rises.

Early signs suggest expectations for rates and inflation are declining because the economy is weakening.

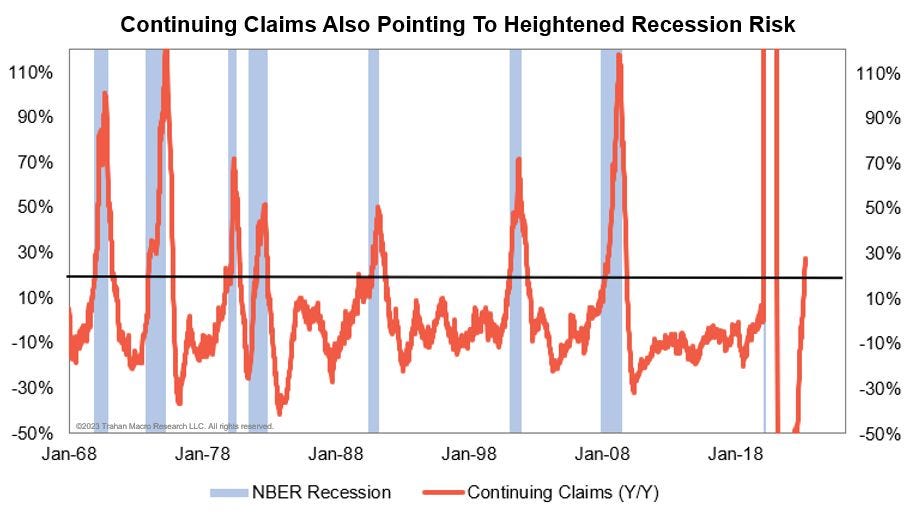

Continuing unemployment claims are rising

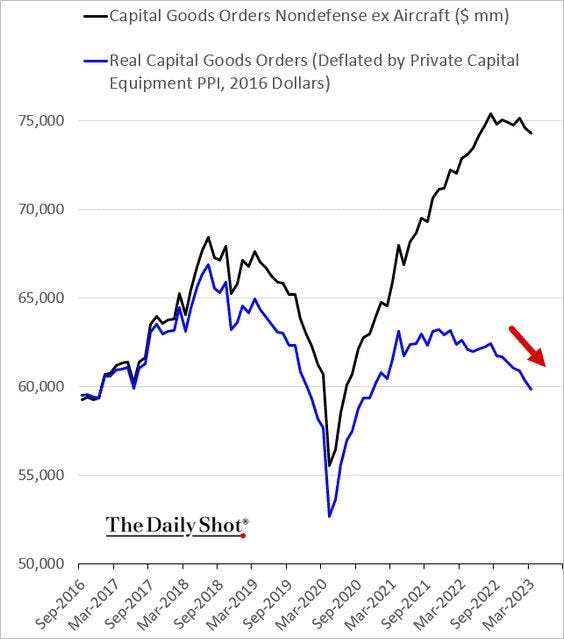

Capital goods orders - especially in real terms - have rolled over

Actual QoQ GDP released Thursday came in significantly lower than expectations (1.1% vs 2%)

2024 GDP estimates continue to get revised downward

Show me the Growth!

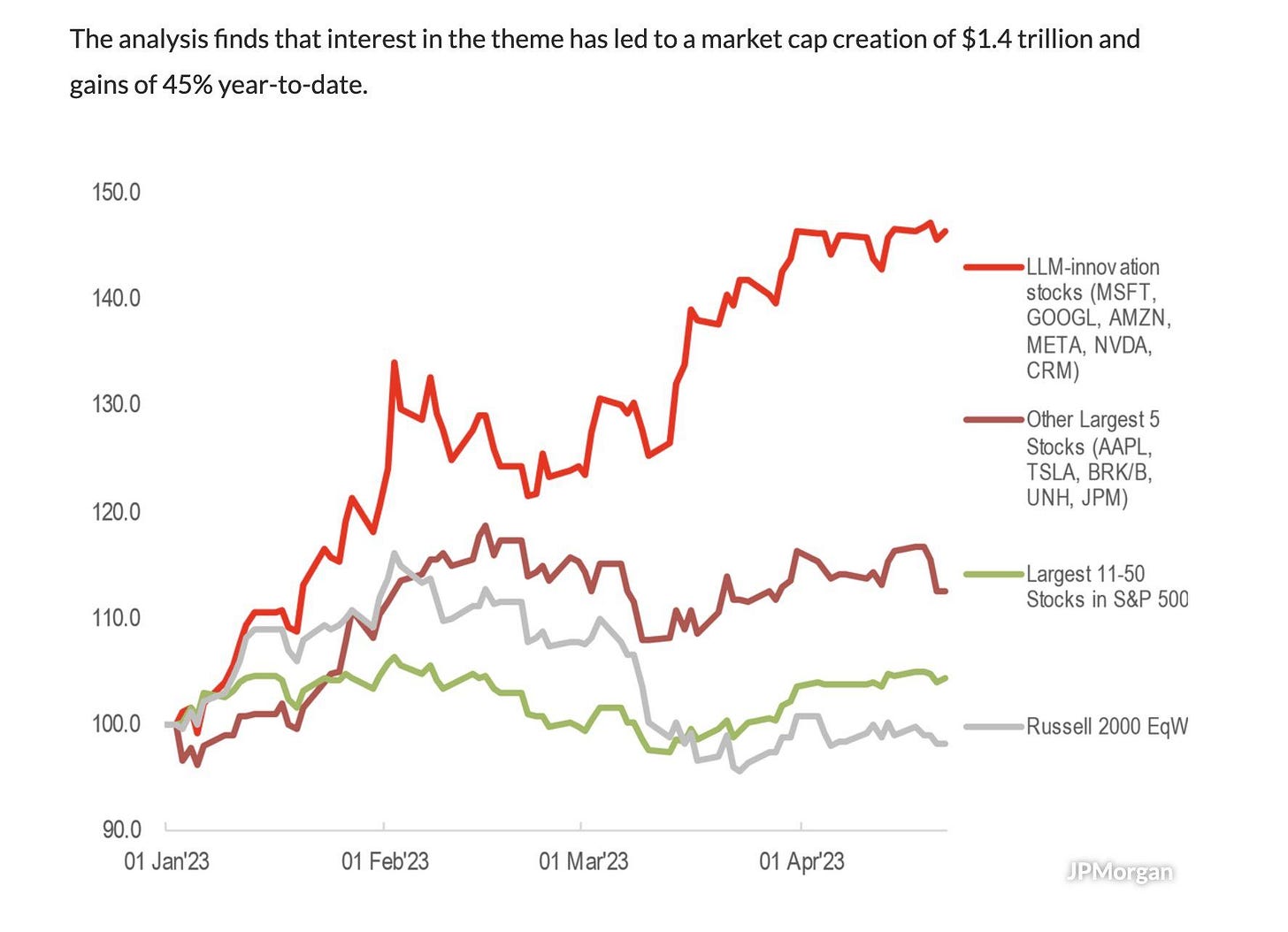

Bucking the overall economic erosion trend, stocks have rallied YTD. Leading the pack are the companies driving AI innovation.

In my opinion, the generative AI revolution is not hype. The late 2022 release of ChatGPT triggered a Cambrian explosion of development, with hundreds (maybe thousands) of new applications and improvements released weekly. The productivity gains are real and the easy to kill jobs (e.g. contract writing) are already under attack. More complex fields - legal, accounting, coding, art, music - are next.

Those who learn how to leverage the technology (or own the technology) will 10x their productivity and reap the rewards. Those who don’t will either lose their jobs or be forced to accept much lower pay to remain competitive.

The AI arms race has begun and it will hit white collar workers like a bag of bricks. While many agree with what I’m saying, most say it won’t happen to them.